By Santhosh V Perumal/Business Reporter

The Qatar Exchange, which has so far witnessed a spate of corporate results, occupied a place in the extreme bottom half among the seven Gulf bourses during the week.

While the 20-stock Qatar Index and Total Return Index rose 0.4% each, Dubai saw its bourse surge 1.85%, Kuwait (1.73%), Saudi Arabia (1.15%), Abu Dhabi (0.9%), Muscat (0.78%) and Bahrain (0.29%) in the week.

Qatar’s performance was also rather sluggish vis-à-vis other Gulf neighbours year-to-date (YTD) with the key index gaining 5.19% scale, whereas Dubai and Abu Dhabi were the first two best performers with their indices expanding 16.73% and 11.56% respectively. Kuwait reported 7.81% gains, Saudi Arabia (3.85%), Bahrain (2.41%) and Muscat (2.39%).

Strong buying, especially in consumer goods, transport, telecom and banking stocks, led the QE to maintain the bullish momentum during the review week that saw news reports on looming ‘currency war’ although the G7 countries — the US, Japan, Germany, Britain, France, Canada and Italy — jointly held that their fiscal and monetary policies would not target exchange rates.

The newly introduced Al Rayan Islamic Index was up 0.04% in the week that saw Gulf International Services (GIS) being one of the active stocks and to have appreciated the maximum.

Other major gainers included Nakilat, Qatar Islamic Bank, Doha Bank, QNB, Mawashi, Qatar Insurance, Qatar Telecom, Vodafone Qatar and Gulf Warehousing; even as Industries Qatar, Qatari Investors Group, Barwa, Ezdan and Mazaya Qatar bucked the trend.

The QE All Share Index (comprising wider constituents) gained 0.59% with the insurance index gaining the maximum of 3.23%, followed by consumer goods (2.28%), transport (1.29%), telecom (0.92%) and banks and financial services (0.91%); whereas the indices of realty and industrials fell 0.96% and 0.4% respectively.

Telecom, industrials, consumer goods and transport sectors were seen to outperform the key barometers with their indices gaining YTD 12.19%, 6.26%, 6.04% and 5.6% respectively; while banks and financial services rose 4.82%, insurance by a paltry 0.09%. The real estate index, on the other hand, fell 0.17%.

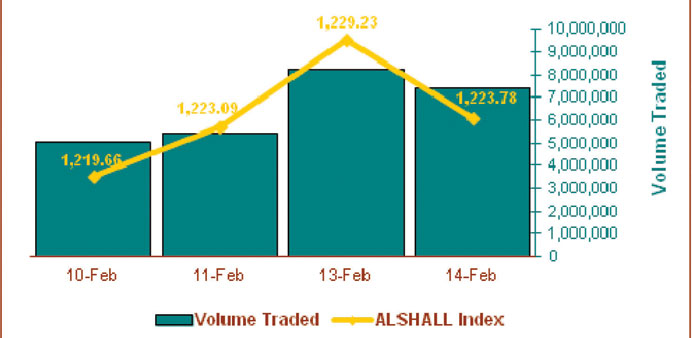

Of the 42 stocks; 24 advanced, while only 16 declined and two were unchanged in the week that saw the market reach its peak on Wednesday.

Seven of the 12 banks and financial institutions, four each of the eight consumer goods and the five insurers, three each of the eight industrials and the three transport, all of the two telecom and one of the four realty stocks close higher in the week.

Market capitalisation gained 0.22% or more than QR1bn to QR476.78bn with small, mid and large cap equities notably adding 1.5%, 1.31% and 0.29% respectively in the week.

Mid, large and small cap equities have gained 6.6%, 4.17% and 1.45% respectively; while micro caps lost 1.99%.

The bourse’s price-earning ratio, a measure of expensiveness, was more than 12 times in the second week of February against 11.79 times in the comparable period of 2012.

The price-to-book value was 1.73 times at the end of February 14 against 1.63 times in the year-ago period.

Total trading volume fell 14% to 26.07mn shares, while value rose 30% to QR1.31bn but transactions were down 9% to 14,574 in the week.

In terms of volume, banks and financial services stocks accounted for 26.7% of the total against 26.17% the previous week, real estate 24.43% (30.15%), industrials 22.44% (15.12%), transport 12.77% (16.68%), consumer goods 6.6% (5.33%), telecom 5.10% (4.86%) and insurance 1.96% (1.69%).

The transport sector’s trading volume plummeted 34% to 3.33mn shares, realty by 30% to 6.37mn, banks and financial services by 12% to 6.96mn and telecom by 10% to 1.33mn; while that of industrials gained 28% to 5.85mn and consumer goods by 7% to 1.72mn. The insurance’s trading volume was flat at 0.51mn.

In terms of value, the industrials sector’s shares constituted 41.52% of the total compared to 22.67% a week ago, banks and financial services 25.65% (32.27%), consumer goods 9.86% (8.59%), real estate 9.17% (14.99%), telecom 6.12% (8.65%), transport 5.05% (9.58%) and insurance 2.63% (3.25%).

The industrials sector’s stocks trading value more than doubled to QR544.14mn, consumer goods’ surged 49% to QR129.19mn, insurance by 5% to QR34.46mn and banks and financial services by 3% to QR336.11mn; whereas that of transport plunged 32% to QR66.19mn, realty by 21% to QR120.16mn and telecom by 8% to QR80.22mn.

IQ stocks accounted for 31.06% of the total stocks trading value, GIS (7.81%) and QNB (6.69%).

In terms of transactions, the banks and financial services sector’s share in total was 26.96% against 29.74% the previous week, industrials 25.16% (20.02%), real estate 14.22% (18%), consumer goods 13.19% (10.11%), transport 8.73% (13.11%), telecom 8.14% (6.83%) and insurance 3.60% (2.19%).

The transport sector’s stocks transactions tanked 39% to 1,272; real estate by 28% to 2,072 and banks and financial services by 17% to 3,929; while those of insurance expanded 50% to 524; consumer goods by 19% to 1,923; industrials by 14% to 3,667 and telecom by 9% to 1,187.