By Pratap John

|

|

Qatar’s international reserves are likely to scale up to $485bn by 2017 even as the country continues to “build large financial buffers against adverse global shocks”, shows a new report.

Qatar, according to Beltone Financial, has the “appropriate policy mix to manage domestic and external risks”.

Qatar continues to build large financial buffers against adverse global shocks. Despite large external debt, Qatar has foreign exchange reserves of more than 100% of GDP.

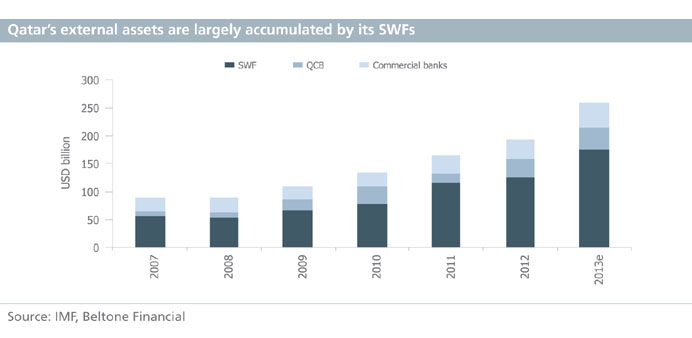

It has been the government’s practice in recent years to transfer up to 50% of LNG export earnings to the Qatar Investment Authority (QIA) as part of a strategy to diversify hydrocarbon income abroad, Beltone said. “Reflecting the buildup in foreign exchange reserves”, external assets by the QIA are estimated to have reached $175bn (90% of GDP) in addition to official reserves of around $39bn (20% of GDP) at Qatar Central Bank as of end-October in 2013.

With LNG revenue being excluded from the budget, the IMF estimates that Qatar will manage to save around $50bn a year through its sovereign wealth fund (SWF), bringing international reserves to a total of $485bn by 2017.

“We believe that Qatar will be able to deliver its infrastructure requirements for World Cup 2022 and wider Qatar National Vision 2030. A change in the timing of the World Cup is unlikely to have any effect on our outlook, in our view,” Beltone said.

On the domestic front, the authorities are taking steps to mitigate implementation risks of the large infrastructure investment programme. This includes prioritising projects in the transportation sector, which accounts for the major part of the infrastructure investment programme.

This should help alleviate construction bottlenecks and wider congestion problems, the report said. Moreover, the authorities have been increasing storage capacity and strategically stockpiling raw materials to prevent the escalation of prices.

The authorities have also assigned the Central Planning Office with the task of coordinating among agencies to ensure the timely delivery of infrastructure projects.

Recent initiatives to develop the domestic debt market will enhance options for domestic financing and reduce reliance on foreign funding, Beltone said. Qatar Central Bank has been issuing T-bills issues since May 2011 with QR4bn on a monthly basis at three-, six-, and nine-month maturities.

As of March 2013, it started issuing QR3bn worth of conventional bonds and QR1bn in sukuk on a quarterly basis at three- and five-year maturities. Aside from liquidity management, we believe this is also to create a domestic yield curve, especially given that local funding requirements are likely to rise from 2014 as investment activity starts to pick up.

Other steps have also been taken to list government bonds and T-bills on Qatar Exchange and set up a domestic credit rating agency. While the government remains in a strong position to increase domestic funding and/or access global capital markets, a secondary debt market will provide an alternative channel to carry out the infrastructure investment programme, the report said.