Bloomberg/Seoul/London

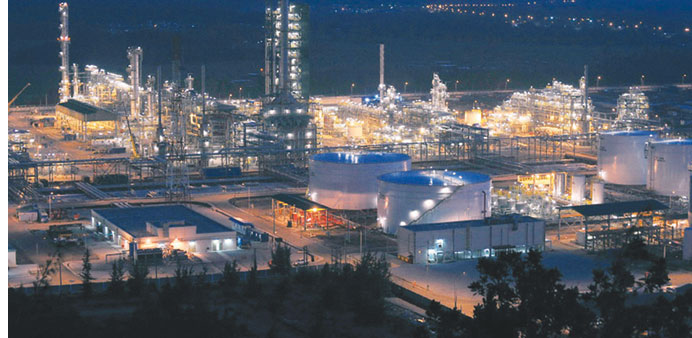

Saudi Arabian Oil Co, the world’s largest crude exporter, will buy a $2bn stake in S-Oil Corp, South Korea’s third-largest oil refiner.

The state-owned producer, known as Saudi Aramco, will buy almost all of Hanjin Energy Co’s stake in S-Oil, according to an S-Oil official, who asked not to be identified because of internal policy.

The purchase was earlier reported by the Maeil Business Newspaper, which cited S-Oil chief executive officer Nasser al-Mahasher saying Aramco will buy Hanjin’s entire stake.

Dhahran-based Aramco, the South Korean refiner’s largest shareholder, currently owns 35% of S-Oil, followed by Hanjin’s 28.4%, according to data compiled by Bloomberg.

An e-mail to Aramco outside of normal business hours wasn’t immediately responded to.

Korean Air Lines Co, South Korea’s biggest carrier, said on December 19 that it planned to sell 30mn shares of S-Oil as part of a plan to raise 3.5tn won ($3.2bn) through asset sales to cut debt.

Hanjin Energy bought its stake in S-Oil for 2.4tn won in 2007. Korean Air owns 96.6% of Hanjin Energy.

S-Oil was up 6.7% at 72,200 won as of 10:30am in Seoul trading after earlier surging as much as 8.3%, the most since December 2011, to 73,300 won. The benchmark Kospi Index gained 0.5%. Korean Air advanced as much as 4.4%.

Meanwhile, Saudi Aramco will supply full contractual volume in February to customers in Europe, unchanged from this month, according to two refinery officials with knowledge of the matter.

Saudi Aramco will provide 100% of crude cargoes sold under long-term contracts, said the people, who asked not to be identified because the agreements are confidential.

While Aramco has the option to reduce monthly sales volumes to term buyers, the producer has not done so since November 2009.

Aramco in September exported 910,000 barrels a day of Arab Light and Extra Light blends to European members of the Organisation for Economic Co-operation and Development excluding Estonia, Hungary and Slovenia, the International Energy Agency said in its monthly oil market report on December 11.

No Arab Medium was shipped to Europe, compared with 30,000 barrels a day in August.