|

|

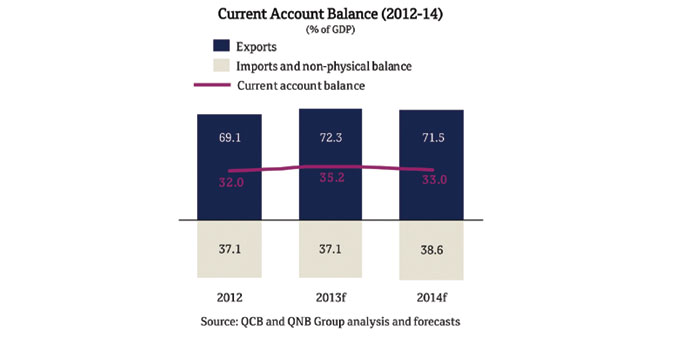

Rising exports of gas-to-liquids (GTL), petrochemicals and fertilisers and higher crude prices will keep Qatar’s current account surplus high, averaging 34.1% of the GDP this year and in 2014, QNB has said in a report.

Current account surplus denotes the country’s exports outweigh imports. This translates into higher savings for the country, which are used to create more assets and retire existing debts.

In its Qatar Economic Insight, QNB said the relatively high oil prices would continue to produce large current account surpluses for the country.

The current account will continue to register large surpluses in 2013-14, supported by relatively high oil prices.

“We expect Brent crude oil prices to average $105/barrel in 2013-14, which will sustain hydrocarbon export receipts. This, coupled with rising exports of GTL, petrochemicals and fertilisers, is likely to more than offset the strong demand for imports driven by public investment and the growing population.

“Accordingly, the current account surplus is likely to remain in the 33%-36% of GDP range over the medium term.”

In 2012-13, the current account surplus rose sharply (32% of GDP) on record-high gas and non-oil exports.

Overall, QNB expects a fiscal surplus of 4.7% of GDP in 2013 and 2.6% of GDP in 2014. Over the medium-term, it projects a moderation in hydrocarbon revenues on softer oil prices and a further increase in current and capital expenditures, leading to smaller surpluses.

“The large fiscal surplus will reduce gross government debt over the medium term,” QNB said.

The government is likely to use a portion of its large fiscal surplus to reduce gross government debt.

The rise in the ratio of government debt to GDP to 37.8% in 2012 was mainly related to the government policy to build a domestic yield curve.

The current level of domestic debt is now broadly adequate to establish a well-functioning market for long-term corporate debt.

“We therefore expect the government to reduce its gross government debt gradually over the medium term, while continuing to build up its large net asset position,” QNB said.

In the last financial year (2012-13), stronger fiscal surplus (13.2% of the GDP) was achieved on the back of strong hydrocarbon revenues and under-spending in the capital budget.

GDP ‘set to grow 6.5% this year’

With large-scale public infrastructure projects becoming a key growth driver, Qatar’s GDP will grow 6.5% this year and at a higher pace – 6.8% in 2014, according to the new QNB report. Qatar’s investment in large scale public sector infrastructure projects offset relatively low growth in the hydrocarbon sector due to the moratorium on additional natural-gas development projects in the North Field, QNB said in its Qatar Economic Insight. These infrastructure projects, part of the build-up to the 2022 World Cup to be held in Qatar, will stimulate buoyant economic activity in construction, financial services, and housing. These projects include the construction of the Qatar Rail Development Programme, including the Doha metro rail network and the expansion of the road network, it said. Page 33