In the recent past, news about various Islamic finance initiatives in Africa made it on the business pages across the world, indicating that the continent is gearing up for a new form of banking. The Economist in a July article even called Africa “Islamic banking’s new frontier,” and the Malaysia International Islamic Finance Centre (MIFC) in June came up with a compact update on the state of Islamic finance in Africa and an outlook on the opportunities it could bring. Additionally, consulting firm Ernst & Young (EY), which operates an Islamic finance centre in Johannesburg, South Africa, and the international Monetary Fund (IMF) are putting the issue regularly on the cards.

It turns out that Islamic finance in Africa is driven by four components: Firstly, economic growth in many African nations supported by improving fundamentals, growing domestic demand and stronger regional integration.

Secondly, it’s demographics. With a population of about 1.2bn people, Africa is currently developing a middle-class segment of its population expected to boost demand for Islamic retail banking, takaful and Islamic funds.

Additionally, financial literacy is improving across the continent, including on Shariah-compliant financial products, which are seen as one driver for financial inclusion.

But, and this is the most important aspect, Islamic finance in Africa is also heavily backed by the continent’s urgent demand for new and alternative ways to fund the much-needed infrastructure, which has been a big challenge in the past for almost all African countries.

Experts state that, notably, sukuk could play a potential role in funding large infrastructure projects, mainly new airports, power plants, roads and railways. With sukuk, the IMF noted, African nations could tap into growing Islamic financial markets to meet infrastructure financing needs instead of using conventional financing from international finance institutions such as the World Bank or the African Development Bank; or relying on borrowed Chinese money. Instead, by opening doors to Islamic finance, Africa can seek to attract capital from Gulf Cooperation Council countries and other Muslim nations or institutional or private investors.

Another avenue for Islamic finance in Africa is funding of small and medium enterprises (SMEs), as well as microfinance, both instruments to increase financial inclusion on the continent.

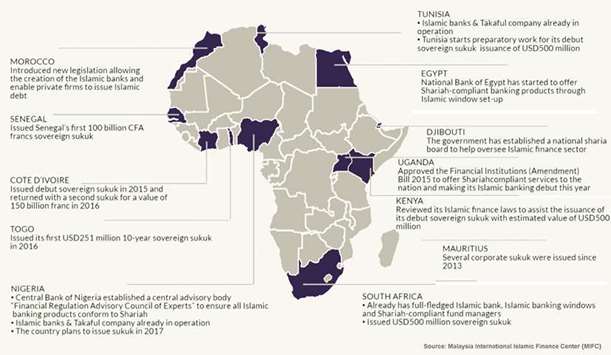

The MIFC in its recent report points out that Islamic finance in Africa has started to gain traction from 2013 onwards, when several countries began to successfully issue sukuk, followed by establishing a regulatory framework that allowed and supervised the operation of Islamic banks and financial institutions. It started with a $63mn-sukuk issued by the Nigerian state of Osun in 2013, saw other sukuk being issued in Senegal, South Africa, Cote d’Ivoire and Togo.

Kenya revamped its Islamic finance laws to allow for the first sovereign sukuk issuance in the budget year 2017/18, while Nigeria stands ready to issue its first government sukuk later this year. In addition, the Africa Finance Corporation, a pan-African multilateral lender based in Nigeria, in June 2017 issued a three-year $150mn sukuk – the first African government-backed entity to do so – which was oversubscribed by more than 50%.

“The core values of Islamic finance and the need to invest ethically in assets that have a tangible positive social impact made a sukuk issuance a natural choice for us,” said Andrew Alli, Africa Finance Corporation’s CEO, adding that “we offer global investors the chance to be involved in high-impact infrastructure projects that not only promote social and economic development across Africa but also generate economic returns for our investors.”

As per mid-2017, Nigeria, Sudan, South Africa and Senegal, Kenya, Morocco and Niger, among others, have put in place necessary legal and regulatory frameworks to enable domestic Islamic banking, while countries such as Uganda, Ethiopia and Zambia are currently exploring and developing the system.

According to the MIFC, there are now more than 50 fully-fledged Islamic financial institutions in Africa, while a considerable number of conventional banks have opened Islamic windows to address the new target group of Islamic banking clients.

Some countries are already in an advanced stage: For example, Kenya, the largest economy in East Africa and the continent’s ninth-largest, is working towards the goal to become a regional hub for Islamic finance products after the country’s treasury ministry presented a roadmap to fully integrate Islamic financing in the country’s financial system as an effort to stimulate economic growth and support infrastructure financing.

As for future potential, the MIFC report noted that Africa has almost 60% of the world’s uncultivated land and vast unexploited natural resources, particularly in Sub-Saharan Africa where large oil, gas and mineral deposits are waiting to be tapped.

Africa is also currently the second most populous continent on earth, and the number of people is expected to double by 2050. This makes a case for Islamic finance to foray not just into infrastructure, but also in the commodity sector, as well as to provide access to financial services for the widely unbanked population.

That way, it would additionally help alleviating poverty by creating opportunities through Islamic microfinance for the underprivileged, who would be enabled to set up and economically maintain micro, small and small and medium-sized enterprises, the pillar of a healthy domestic economy.

.