Qatar, which is planning to build three new liquefied natural gas (LNG) trains to target the tighter LNG market expected in the mid-2020s, could rather look to partner with companies that have strong existing relationships with Chinese buyers to bolster its position in this market, according to BMI, a Fitch company.

The expansion offers substantial opportunities for oil majors to expand their gas portfolios and Qatar to grow exports to new markets, BMI said, highlighting that Qatar has unveiled plans to develop three new LNG trains in order to achieve the 100mn tonnes (Mtpa) capacity target set in its mid-2017 expansion programme.

Initially, BMI had expected the 23Mtpa of capacity growth to come from a mixture of debottlenecking work at existing mega-trains, in addition to two new-build production trains.

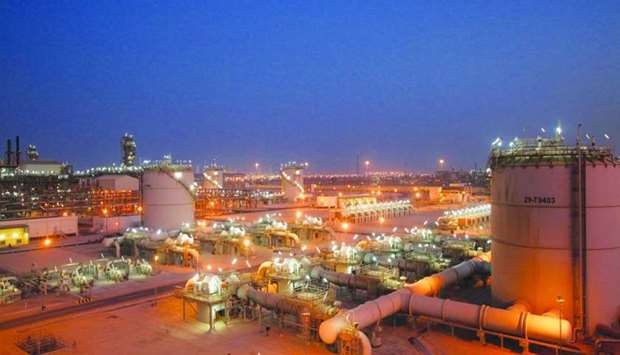

"While in our view debottlenecking poses an attractive opportunity to boost output from Qatar's existing trains, feasibility investigations have reportedly highlighted challenges with undertaking work in a somewhat congested environment surrounded by operating LNG facilities," it said.

The risks associated with debottlenecking in such an environment, and the downtime in production required to undertake upgrades, are now thought to hold negligible cost savings over a new build train, it added.

Qatar will then proceed with the development of three new 7.8Mtpa mega-trains to add to the existing 77.1Mtpa processing capacity. The final investment decision on the expansion is being targeted for early 2020, with the hope that new capacity will be ready from 2024, around the period the LNG market is expected to get tighter.

Qatar has previously offered 30-35% equity stakes in its LNG trains. ExxonMobil in particular has a strong relationship having equity stakes in 12 of Qatar's 14 trains; ConocoPhillips, Total and Shell are also present in the newer Qatari trains.

The construction of three new trains (as opposed to debottlenecking) also offers the country an opportunity to expand its relationships with more international oil companies, and potentially those with established access to growing LNG import markets.

Finding that Qatar has been successful in tapping some of the fastest growing LNG markets over recent years, BMI said in 2016 Qatari LNG dominated imports of India, Pakistan, Thailand and Egypt.

However, Qatar's position in China remains comparatively under-represented at around 18%, with Australia holding around 46% of the market, it found.

"While it is not definite that Qatar will sell equity stakes in the new trains, the country could look to partner with companies that have strong existing relationships with Chinese buyers to bolster its position in this market," it said.