Asia’s latest ‘tiger’ however, is Vietnam with the latest data showing its economy roaring in 2018 as it emerges as one of the world’s fastest growing economies, QNB said in its latest report.

A range of indicators show Vietnam’s booming economy. GDP growth raced ahead by 7.1% year-on-year (y-o-y) in the first six months of 2018 – the economy’s fastest growth since 2011. The manufacturing sector is leading the charge with output up 13.1% y-o-y in the first half of the year. Construction is also playing a strong supporting role with output in that sector up 7.9% y-o-y over the same period.

The counterpart to Vietnam’s manufacturing boom is surging exports. Monthly trade statistics can be highly volatile but the latest data show goods exports up over 20% y-o-y in the first half of the year, following growth of over 17% in 2017 as a whole, QNB said.

Manufacturing and export success has been driven by Vietnam’s ability to attract large foreign direct investment (FDI) inflows into sectors such as clothing, footwear, and, above all, electronics.

It is now estimated, for example, that one in 10 smartphones worldwide are now made in Vietnam. Latest data show FDI inflows also booming.

These were worth an estimated $13bn in H1 2018 with an 11% y-o-y growth.

To put these FDI inflows in context, QNB said Vietnam’s GDP in 2017 was worth around $220bn, according to the latest data from the International Monetary Fund (IMF).

“Vietnam’s economic success is noteworthy as it comes at a time when many developing economies are struggling to match the success of Asia’s earlier ‘tigers’ and sustain rapid economic growth through manufacturing and export booms.

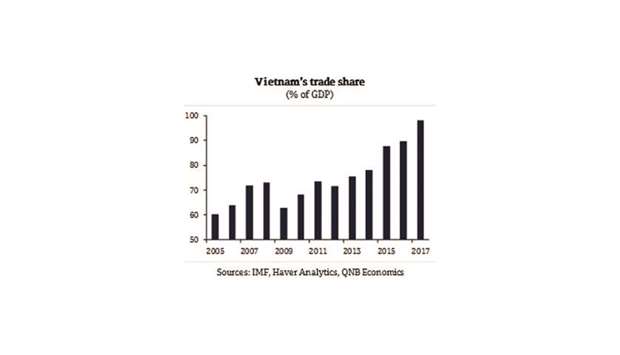

“India’s export sector, for example, has laboured in recent years despite a vibrant economy in other respects. By contrast, Vietnam has seen trade soar to nearly 100% of GDP, up from around 60% in 2005 and 75% as recently as 2014,” QNB said.

QNB said the foundation of Vietnam’s success is obvious: favourable demographics and low wage rates. Political stability also helps as does the country’s geographical location. Vietnam is also close to major global supply chains, particularly in electronics, which have emerged over the last decade or so.

But these factors are far from specific to Vietnam and so only explain a portion of its success. Recent research from the Brookings Institute think tank in the US highlights that it has been the ability to build on these solid foundations through good policies is what really sets Vietnam apart.

QNB said three factors in particular have been critical. First, while many in the West are questioning the benefits of free trade, Vietnam has zealously pursued trade liberalisation on both a multilateral and bilateral basis.

Vietnam, for example, has recently concluded a free trade agreement with the European Union, which eliminates nearly all tariffs between the two. Trade agreements have dramatically lowered the external tariffs its exports face, helping integrate Vietnam into the global economy and further accelerating FDI investments.

Second, Vietnam’s investments in human capital i.e. education have been impressive, helping the country maximise its demographic potential. A stand out is that the OECD’s latest Programme for International Student Assessment (PISA), which tests high school students in math, science, and other subjects, ranked Vietnam an impressive eighth out of 72 participating countries - ahead of many leading OECD economies.

Third, investments in human capital have been supported by progress in improving the country’s business climate. Vietnam has steadily moved up in both the World Economic Forum’s competitiveness index and also the World Bank’s ease of doing business survey. Investments in physical infrastructure such as power generation, roads and bridges, and container port capacity have been vital in supporting Vietnam’s rich human capital.

“Impressive as Vietnam’s recent economic achievements have been, the country cannot afford to rest on its laurels. The very nature of its success brings with it vulnerabilities and future challenges.

“As already highlighted, FDI has been largely concentrated in the textiles and electronics sectors. The jobs created by these investments tend to be relatively low-skill and low-wage with little value added. This leaves Vietnam exposed to the cross-fire of a US-China trade war (along with Asian other economies enmeshed in the electronics global supply chain such as Taiwan and South Korea) in the short term,” QNB said.

Longer-term, Vietnam’s competitive advantage will necessarily fade as the country climbs the development ladder and wage rates and living standards improve, according to QNB.

“New drivers of economic development will need to be found to ensure that Asia’s newest ‘tiger’ economy does not risk extinction in a few years. There are clear reasons for optimism however.

“Vietnam’s high PISA scores suggest that the country should be able to move up the global value chain more easily than most emerging markets. Prospects for rapid growth in the service sector are also fair with tourism a prime candidate to help drive economic growth over the longer-term. In fact, with the latest data showing tourist arrivals up nearly 25% y-o-y in June, this growth engine is already helping the country power ahead,” QNB said.