GCC economies have bounced back since the 2020 pandemic, PwC said and noted the region’s non-energy sector recovery has been aided by tourism, notably in Qatar and Saudi Arabia.

This positive outlook is attributed to high oil prices and strong balance sheets at the sovereign and corporate levels, as well as continued diversification and economic resilience as countries pursue their national visions, , PwC said in its ‘Middle East economy watch’.

However, the wider Middle East remains more vulnerable to these global trends, PwC noted.

The sectors that were hardest hit in the region during 2020 were the same as experienced globally, including hospitality, transportation and retail/wholesale trade.

Hospitality declined by nearly a third, transportation by a sixth and trade by nearly a tenth. These sectors are all partly driven by domestic demand and partly by tourism.

The dip in domestic demand was largely temporary, with tourism slower to recover, but the gap has been closing quickly.

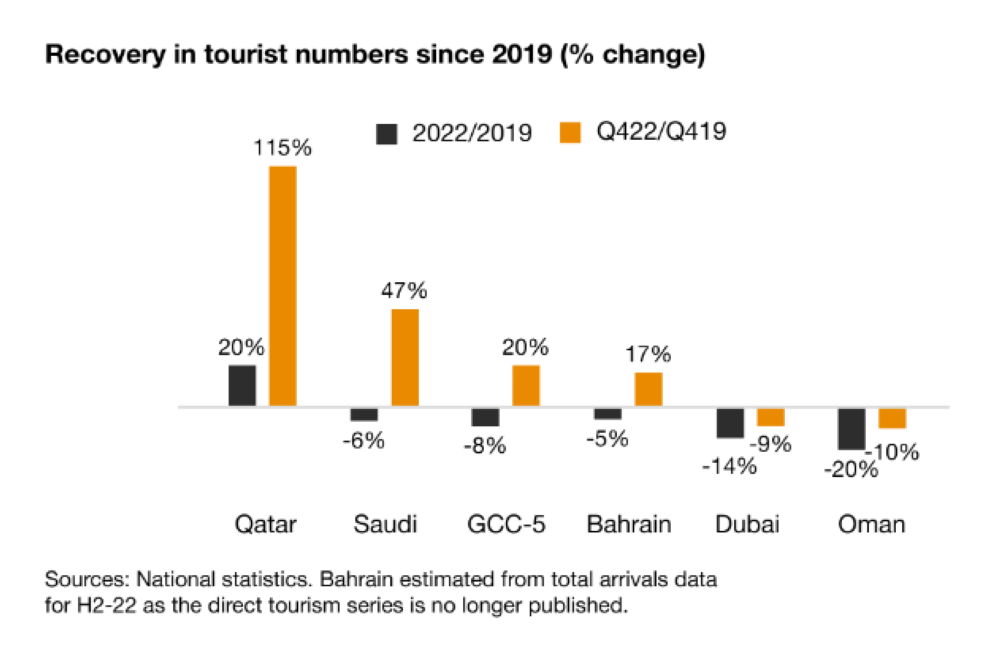

In 2022, the five states for which regular tourism data is available, lagged 2019 levels by -8%. However, by Q4, three of the five were well above Q4-19.

“Although Qatar’s surge was a temporary boost from the World Cup, its monthly numbers have remained solid in early 2023,” PwC noted.

Recovery in expat numbers: In Oman, Qatar, Saudi Arabia and Bahrain, where the population data is most readily available, there has been a strong rebound over the last 18 months, the report noted.

By end-2022, expat numbers were above pre-pandemic levels in Bahrain, Qatar, the Saudi Arabia and Oman.

In Oman and Bahrain this boost has largely been due to renewed hiring thanks to higher oil prices and other economic drivers, and elsewhere in the GCC recent initiatives such as new visa legislation, alongside geo-political migration drivers from outside the region, will continue to attract more expatriates to the GCC.

Indeed, across the region as a whole expat numbers rebounded by 2.8% in 2022 and should surpass the 2019 level later this year, the report said.

According to the report, the GCC is especially well placed to implement their long-term National Vision transformation plans due to substantial financial resources to direct to their objectives, and the leadership continuity and commitment to see them through.

Overall, progress on key KPIs across the region is promising, with some room for improvement on others.

Richard Boxshall, partner and chief economist commented: “The GCC as a whole is making good progress towards achieving its countries’ National Visions, with areas of common focus including non-oil diversification, improving infrastructure, advancing digitalisation, creating competitive business environments and workforce nationalisation targets for the private-sector.

“Most GCC countries are also advancing towards their sustainability objectives, such as investing in solar generation capacity. With COP28 on the horizon, we expect the momentum and reinvestments driving this transformation to increase”.

The report highlights that the region has been quick to secure the non-oil recovery, even in the hardest-hit sectors of hospitality, transportation and retail/wholesale trade.

In 2022, the five GCC states for which regular tourism data is available, Saudi Arabia, UAE, Qatar, Bahrain, and Oman, showed a lag of -8% behind 2019 levels. However, by Q4, Qatar, Saudi and Bahrain were well above Q4, 2019 levels.

Stephen Anderson, partner, Middle East Strategy and Markets Leader, said, “The GCC economies have shown great resilience in the face of many obstacles being experienced globally, with the growth of the non-oil economy and increased focus on sustainability enabling them to lead the diversification agenda on a larger scale. “Continued government investment in strategic sectors and projects in pursuit of their National Visions will underpin future growth, allowing us to weather the worst of the global slowdown throughout 2023.”

“Although Qatar’s surge was a temporary boost from the World Cup, its monthly numbers have remained solid in early 2023,” PwC noted.