Tighter financial conditions are set to remain in the US and euro area this year on the back of higher monetary policy rates, quantitative tightening, and banking sector strains, QNB said Saturday.

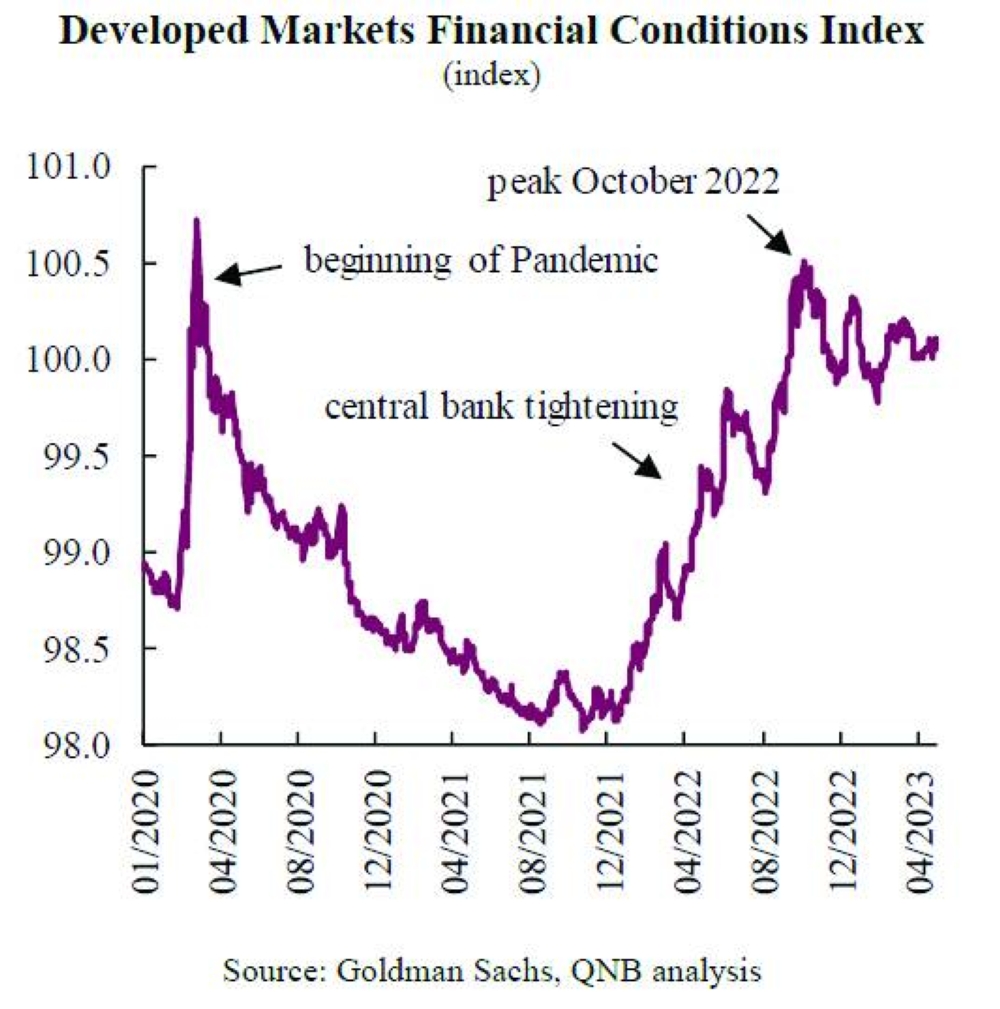

Financial conditions across advanced economies are at the tightest levels since the onset of the Covid-pandemic, QNB said in an economic commentary.

A good indicator is provided by the Financial Conditions Index, which combines information of short- and long-term interest rates, and credit spreads, and therefore summarises the costs of credit in the financial system. The index began a steady upward trend at the beginning of 2022, and has remained elevated since the end of last year.

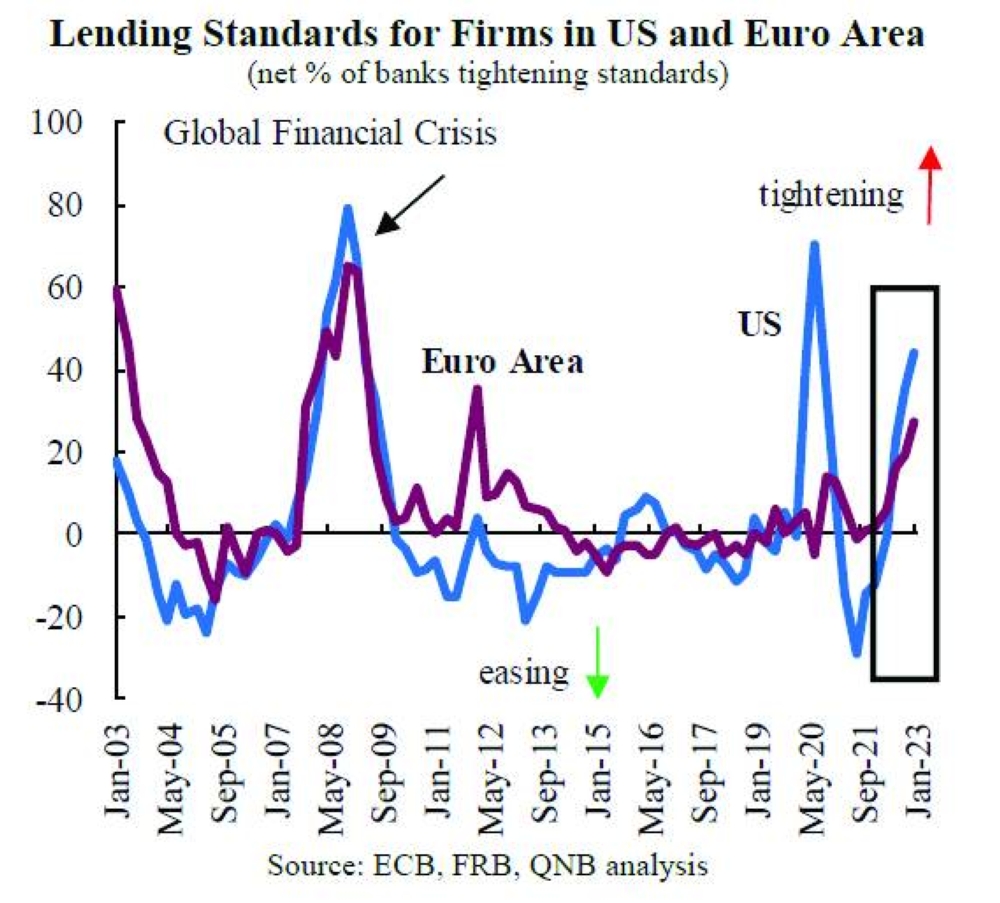

In addition to higher credit costs, credit availability is becoming increasingly constrained. Lending standards for loans given by commercial banks in the US and the euro area have become tighter since the second half of last year, QNB noted.

In the euro area, the pace of tightening is at the highest since the sovereign debt crisis in 2011. This is translating into higher rates of rejection for loan applications, and lower credit volumes for firms and households.

In QNB’s view, tighter financial conditions will persist in the next year, in terms of both credit costs and availability. We discuss the three main factors that substantiate our analysis.

First, the interest rate tightening cycles by central banks in the US and the euro area will not be reverted in the near future. In the US, the Federal Reserve Board (Fed) has so far increased its policy interest by 500 bps since March of last year, while the European Central Bank (ECB) has increased its policy rate by 375 bps since June.

But core inflation measures remain high, and tight labour market pressures persist.

In QNB’s view, it will be difficult for the ECB and the Fed to bring currently high inflation back to the 2% target without maintaining higher policy rates for longer. In the case of the ECB, in particular, we expect additional interest rate increases. Higher monetary policy rates mean that credit costs will remain elevated at least until the end of this year.

Second, central banks are reverting the balance sheet expansions that were put in place during the Covid-pandemic, which will further restrain the availability of credit. These programmes provided monetary support through an array of asset purchase programs (APPs) and credit facilities, which were introduced to strengthen the flows of credit and the functioning of financial markets.

In the euro area, July 2022 marked the end of the ECB’s net asset purchases, and in March 2023 policy switched from full to partial reinvestment of redemptions, which implies a faster pace of reduction in the size of the central bank’s balance sheet.

In the US, the plans for reducing the balance sheet of the Fed take the form of caps to the reinvestment of received investment payments.

“We expect this process of balance sheet normalisation, or ‘quantitative tightening’, to persist. Central banks will continue to withdraw excess liquidity from the financial system created by extraordinary and temporary measures, and restore room for monetary policy actions in case they are required in the future,” QNB noted.

Third, the collapse of three regional banks in the US (Sillicon Valley, Signature, and First Republic), and Credit Suisse in Europe fuelled fears regarding the strength of financial institutions, and triggered a drain of deposits.

Most notably in the US, bank deposits are moving from banks to money market funds in search of the safety and returns provided by Treasury securities.

At the end of April, deposits at commercial banks in the US had fallen by $521bn since February, to $17,167bn.

In the euro area, these events added to the already negative trend in bank deposit growth.

Going forward, QNB noted these trends in deposit outflows will have negative implications for bank lending activity, since they reduce the amounts of funds available for extending loans, and increase cautiousness by banks.

“All in all, tighter financial conditions are set to remain this year on the back of higher monetary policy rates, quantitative tightening, and banking sector strains. This results in higher credit costs and lower credit availability for households and firms in a context of weakening economic growth,” QNB added.