Qatari banking sector recorded a growth in its overall loan book and deposits in October, a report by QNB Financial Services (QNBFS) has shown.

The sector’s total assets increased 1% MoM (up 1.8% in 2023) in October to reach QR1.93tn, QNBFS said in its latest monthly report.

Total assets increase in October was mainly due to a gain by 1.2% in domestic assets and 2.5% in foreign assets.

Assets grew by an average 6.9% over the past five years (2018-2022), QNBFS said and noted liquid assets to total assets was at 31.1% in October, compared to 31.5% in September this year.

October recorded an increase in both the credit facilities offered and deposits held by the local banks.

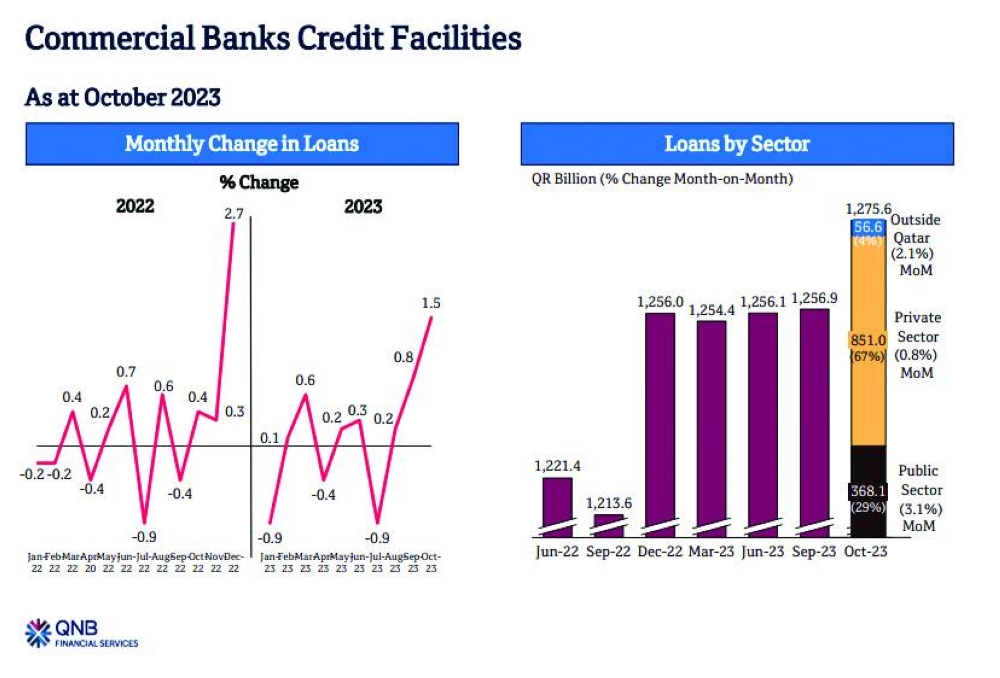

The overall loan book gained in October. Loans went up 1.5% during that month to reach QR1,275.6bn.

Loans gain in October was mainly due to a rise by 3.1% in the public sector and 0.8% in the private sector.

Loans moved up by 1.6% in 2023, compared to a growth of 3.3% in 2022. Loans grew by an average 6.7% over the past five years (2018-2022).

Loan provisions to gross loans was at 3.9% in October, compared to 4% in September.

Total public sector loans was higher by 3.1% MoM (-1.6% in 2023). The government segment (represents 29% of public sector loans) was the main growth driver for the public sector with a surge by 11.2% MoM (-6.8% in 2023).

The government institutions’ segment (represents 64% of public sector loans) edged up 0.1% MoM (-1.6% in 2023).

However, the semi-government institutions’ segment moved lower by 1.1% MoM (+31.0% in 2023).

The services segment was the main driver for the private sector loan rise. Services (contributes 31% to private sector loans) increased 2.5% MoM (+9.1% in 2023), while general trade (contributes 21% to private sector loans) moved up by 0.7% MoM (+5.8% in 2023) and consumption and others (contributes 21% to private sector loans) was marginally up MoM (+5.4% in 2023).

However, the real estate segment (contributes 21% to private sector loans) declined 0.3% MoM (-5.5% in 2023) in October. Outside Qatar loans moved up by 2.1% MoM (2.9% in 2023) during October.

Deposits moved up 2.7% during October to reach QR979.3bn. Deposits increase in October was mainly due to a gain by 2.7% in the private sector and by 3.5% in the public sector.

Deposits have gone down by 2% in 2023, compared to a growth of 2.6% in 2022. Deposits grew by an average 4% over the past five years (2018-2022), QNBFS noted.

Loans to deposits ratio went lower during the month to 130.3% in October.

Loans went up 1.5% in October to reach QR1,275.6bn, while deposits moved up 2.7% that month to reach QR979.3bn.

An analyst told Gulf Times, “The main highlights for the month of October 2023 is the continued growth in both loans and deposits. The overall loans growth was pushed higher by both the public and private sectors. The government overdrafts increased in October, signalling short-term funding needs for the government, while the services segment increase in the private sector indicates the continued demand and growth in the tourism sector.

“The companies and institutions segment showed good growth in deposits, along with the government and semi-government institutions.”