QNB Group, the largest financial institution in the Middle East and Africa, have launched a new option allowing its credit cardholders the option to have their credit card as a virtual card for a complete control, safety and hassle-free experience.

The launch of this service comes as part of the bank’s commitment to limit the use of plastic cards and to encourage digital products for a safer and innovative experience as well as being environmentally-cautious.

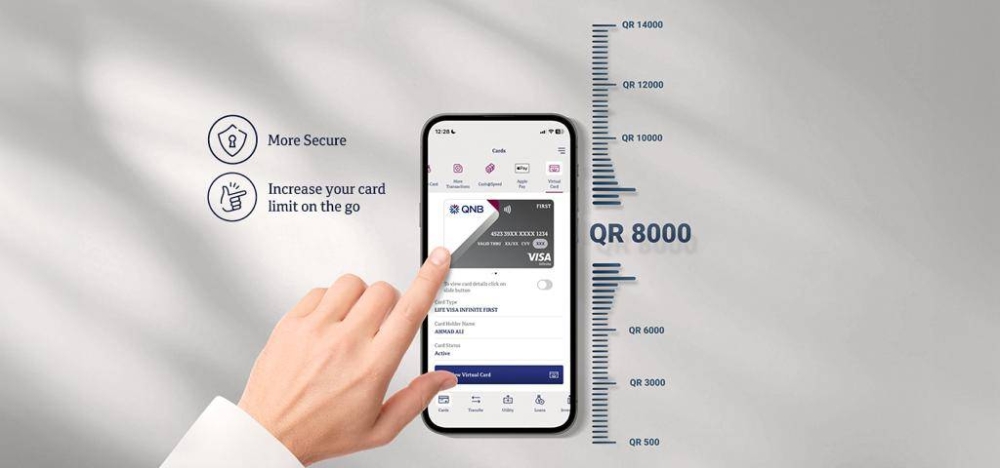

QNB credit cardholders can easily obtain their virtual credit card using QNB Internet and Mobile Banking services. The virtual credit card will be generated dynamically with additional layers of security and instantly activated, and will be made available for use in their smartphones and their digital wallet to ensure a secure and seamless payment experience without the need for card printing and delivery.

Mr. Adel Ali Al-Malki, Senior Executive Vice President of QNB Retail Banking Group said: ‘In an era of consistent increasing demand for digital banking products, we are pleased to introduce the most technologically advanced payment products for our customers. We will continue to deliver the best in-class products and services, which provide our customers with the highest levels of safety and security.

The introduction of this product is also in-line with QNB’s ESG commitments making it an ideal payment option, and we are confident that customers will continue moving from traditional payment methods to electronic ones as part of our sustainability framework and strategy.”, he added.

QNB Group currently ranks as the most valuable bank brand in the Middle East and Africa. Through its subsidiaries and associate companies, the Group extends to more than 28 countries across 3 continents providing a comprehensive range of advance products and services. The total number of employees is more than 30,000 operating through 900 locations, with an ATM network of more than 4,800 machines.