Attendees arrive for Microsoft's event on AI technologies in Jakarta on April 30, 2024. Microsoft will invest $1.7bn to build out cloud computing and artificial intelligence infrastructure in Indonesia, betting on Southeast Asia’s biggest economy to spur growth.

Long considered a tech hinterland, Southeast Asia is fast emerging as a centre of gravity for the industry.

The CEOs of Apple Inc, Microsoft Corp and Nvidia Corp are among the industry chieftains who’ve swung through the region in past months, committing billions of dollars in investment and holding forth with heads of state from Indonesia to Malaysia. Amazon.com Inc just last week took over a giant conference hall in downtown Singapore to unfurl a $9bn investment plan before a thousands-strong audience cheering and waving glow sticks.

After decades of playing second fiddle to China and Japan, the region of about 675mn people is drawing more tech investment than ever. For data centres alone, the world’s biggest companies are set to splurge up to $60bn over the next few years as Southeast Asia’s young populations embrace video streaming, online shopping and generative AI.

Traditionally welcoming to Western investment, the region’s moment has arrived as China turns more hostile to US firms and India remains tougher to navigate politically. Silicon Valley is setting its sights on business-friendly regimes, fast-growing talent pool and rising incomes. The advent of AI is spurring tech leaders to pursue new sources of growth, laying the digital infrastructure of the region’s future.

“Countries like Singapore and Malaysia are largely neutral to the geopolitical tensions happening with China, US, Ukraine and Russia,” said Sean Lim, a managing partner at Singapore-based NWD Holdings, which invests in AI-based projects and other areas. “Especially with the ongoing wars, this region has become more attractive.”

Take Tim Cook and Satya Nadella, who last month embarked on their biggest tours across Southeast Asia in years. The investments they pledged are set to help turn the region into a major battleground between the likes of Amazon, Microsoft and Google in future frontiers such as artificial intelligence and the cloud.

The region’s growing workforce is making it a viable alternative to China as a centre of talent to support companies’ global operations. As its governments pushed for improvements in education and infrastructure, it’s become an attractive base for everything from manufacturing and data centres to research and design.

“The governments are pro cross-border investments and there’s a deep talent pool,” said NWD’s Lim.

Southeast Asia has also become a sizeable market for gadgets and online services. About 65% of Southeast Asia will be middle class by 2030, with rising purchasing power, according to Singapore government estimates. That’ll help more than double the region’s market for internet-based services to $600bn, according to estimates by Google, Temasek Holdings Pte and Bain & Co.

Apple, whose pricey gadgets for long remained out of reach for the vast majority in the region, is now adding stores. Chief Executive Officer Cook toured Vietnam, Indonesia and Singapore in late April, meeting prime ministers and announcing fresh investments as the company seeks new growth regions beyond China, where sales have sputtered.

In Jakarta, besides pow-wows with the country’s leadership, Cook met a local influencer with almost 800,000 Instagram followers over chicken satay, and learned enough of the local language to say “How are you” in a video circulated on social media. On his X account, local customers asked Cook for an Apple Store and better servicing of Apple products in the country. Following the trip, Apple reported its revenue in Indonesia had reached a record, even as total global sales declined.

Microsoft CEO Nadella also received an enthusiastic welcome after meeting with the leaders of Malaysia, Indonesia and Thailand last week. In Bangkok, under a ballroom’s shimmering chandeliers, he was seen shaking hands and conversing with high-ranking government officials and the country’s top business elites.

Southeast Asia’s draw becomes apparent once you consider slowing toplines in Silicon Valley, which is struggling now to lay the foundations of AI — anticipated to become an industry-defining technology. Within the next few weeks, two major AI-themed events in Singapore are set to feature top leaders from OpenAI, Anthropic, Microsoft and others to further tout the technology’s promise for Southeast Asia.

A specific catalyst for the tech companies is generative AI, with services like ChatGPT rapidly gaining users. Southeast Asia’s accelerating AI adoption has the potential to add about $1tn to the region’s economy by 2030, according to a report by consulting firm Kearney.

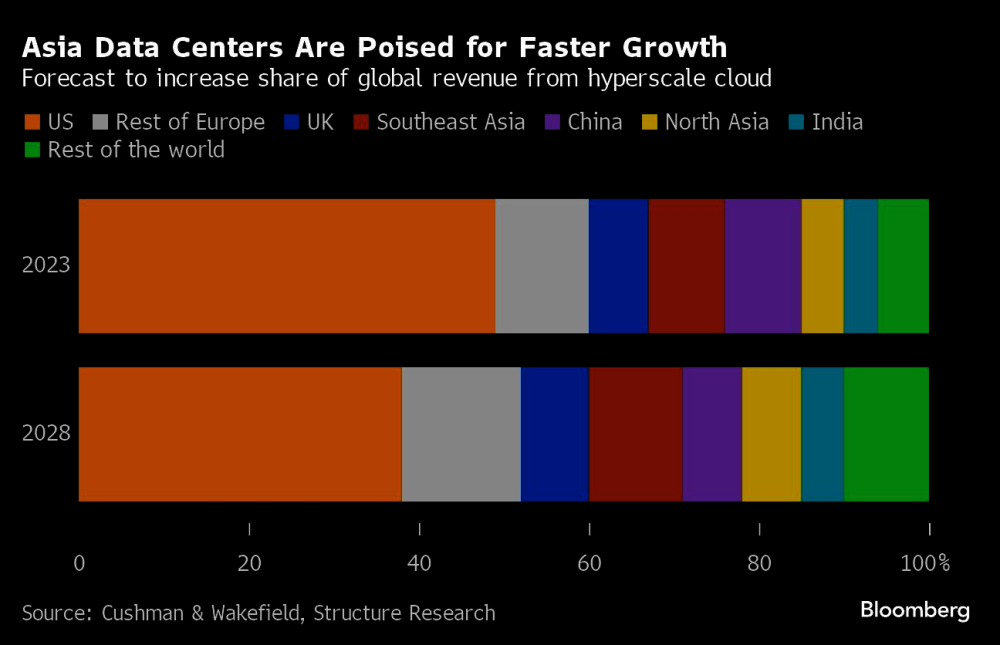

That means more data centres are needed to store and process the massive amounts of information traversing between content creators, companies and customers. Data centre demand in Southeast Asia and North Asia is expected to expand about 25% a year through 2028, according to Cushman & Wakefield data. That compares with 14% a year in the US. By 2028, Southeast Asia will become the second largest non-US source of data centre revenue in the world.

Hotspots include Malaysia’s southern Johor Bahru region, where Nvidia last year teamed up with a local utility for a plan to build a $4.3bn AI data centre park. Nvidia is also targeting Vietnam, which CEO Jensen Huang sees as a potential second home for the company, local media reported during his visit in December. Huang was spotted enjoying street food and egg coffee, a Vietnam speciality, as he hung out with local tech contacts in a black T-shirt and jeans.

The company has since reviewed Hanoi, Ho Chi Minh City and Da Nang as potential locations for investments, with Keith Strier, its vice president of worldwide AI initiatives, touring the cities last month.

A region consisting of about a dozen politically, culturally and geographically disparate countries, Southeast Asia isn’t the easiest market for global companies to operate in. Risks include difficulties navigating local working cultures, as well as the volatility of the various currencies, said NWD’s Lim.

But for now, the tech majors are embracing the region’s advantages such as its relatively low-cost yet highly skilled workforce — helpful for building expensive technologies such as large language models that require not just a lot of cash but also skilled engineers. Most of the US firms announced training programs with local governments, with Microsoft promising to train a total 2.5mn people in AI skills in Southeast Asia by 2025.

“This shift is influenced by both external and internal drivers,” said Nicholas Lee, associate director in political consultancy firm Global Counsel’s Singapore office. “Besides the intensifying US-China rivalry and policy divergence across major jurisdictions, subdued revenue growth and rising costs also underline the need for companies to manage expenses prudently.”