The AI revolution is increasingly being funded in a little-watched part of the debt market.

Artificial intelligence products need vast troves of information and processing power to turn facts into something approximating human thought. Across the world, companies are pouring billions of dollars into building data centres to store and process this information, and fibre-optic cables to connect computers to these sites and one another.

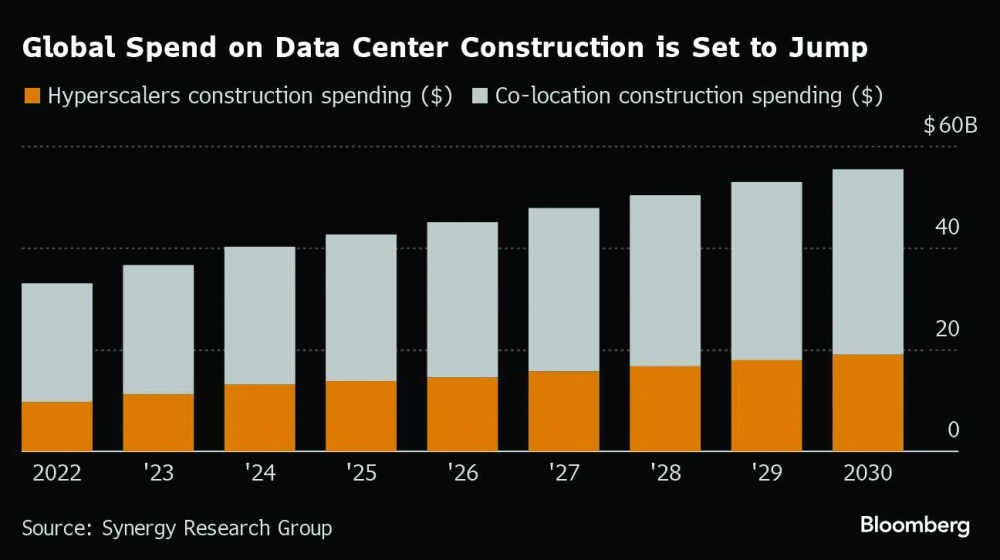

In this way, AI is accelerating the decades-long growth of the Internet and digital infrastructure. Global spending on data centre construction is likely to top $55bn by 2030, according to Synergy Research Group. The companies building data centres are often thinly capitalised, forcing them to raise at least some of that money in the asset-backed securities market, where they can get financing based on the revenue they expect to generate from the properties, at cheaper prices than they might otherwise find.

Earlier this month, Frontier Communications Parent Inc. sold a $750mn bond backed by fibre-optic cables, the biggest portion of which yielded about 6.3%, while Switch Inc. sold a roughly $940mn bond backed by six of its data centres. By the end of 2024, companies are anticipated to raise a record $12bn of financing in the asset-backed securities market, spanning data centres, fibre and related investments, according to Barclays Plc.

These transactions are one of many possible sources of financing for the AI revolution, which also relies heavily on equity, unsecured bonds and loans, among other markets. Data centre and fibre investments are growing for a host of reasons, including employees working from home more since the pandemic.

“Some of the largest companies can raise unsecured debt, but anyone else who’s developing infrastructure for computing is looking for financing right now,” said Erik Falk, partner and head of strategy at Magnetar Capital, an investment firm that has participated in some of these transactions. “That may come in different forms and has led to significant innovation, but some deals may be riskier and look more like equity.”

So far this year, there’s been about $4.7bn of ABS deals backed by data centres — more than double the volume seen at this time in 2023, while fibre-backed ABS sales are up by more than 50%, at $3.5bn, according to data compiled by Bloomberg News.

Some notable transactions include telecom firm Ziply Fiber’s sale of about $1.6bn of asset-backeds in March, supported by revenue streams from its fibre-optic networks, while Zayo Group Holdings Inc plans to tap the ABS market by the end of the year.

Asset-backeds tied to digital infrastructure are also starting to spread outside the US. In early June, Vantage Data Centers completed what it says is the first-ever securitisation of data centre assets in the Europe, Middle East, and Africa region, totalling £600mn ($761mn), partly to refinance debt at its 148MW Cardiff, Wales campus. The deal marks the hyperscale data centre operator’s 10th securitisation since 2018, and follows a €750mn ($815mn) equity raise to capitalise on the boom in AI technology.

“Particularly for data centres, it’s hard not to see digital infrastructure becoming a much larger piece of the pie going forward,” said Robert Graham, head of investments, securitised products at Schroders. “We’ve already seen a massive expansion of the sector – the scale of leasing activity is many multiples what it was just a couple years ago – and the growth potential, fuelled by AI and cloud computing, is exponential.”

Fibre asset-backeds that are hitting the market are also tied to the AI revolution, and to the increasing pervasiveness of Internet connections. More employees are working from home after the pandemic, and more devices are connected to the web, which demands more fibre-optic connectivity. Nearly all US adults used the Internet in 2023 – a significant jump from the turn of the century when only about half of them did.

“Dramatic growth in the world’s data consumption needs has driven equally dramatic growth in the capital needs of digital infrastructure developers,” said Jesse Sable, director of non-flow ABS at Mitsubishi UFJ Financial Group Inc.

While data centre ABS have been around for years, issuance has ramped up as investment has grown. And there are even more unusual kinds of assets, such as microchips and graphics processing units (GPUs), that are getting tied to secured debt, and potentially in the future, asset-backeds.

Cloud computing firm CoreWeave Inc recently clinched $7.5bn of debt split between investment-grade loans and non-investment-grade tranches. The secured borrowing wasn’t in the asset-backed securities market, but is tied to assets including microchips. The Blackstone Inc.-led transaction follows another $2.3bn financing for CoreWeave last year, where the collateral included GPU chips made by Nvidia Corp.

Firms like Digital Realty Trust Inc – a real estate investment trust that operates data centres – have also repackaged their real estate mortgages into bonds and sold them in the commercial mortgage-backed securities market. Both the ABS and CMBS markets offer efficient financing for data centre projects that are generating stable revenue, said Schroders’ Graham. However, he also points out that large, public REITs often fund via the unsecured debt market at a lower cost of capital than securitised products can offer.

“Digital infrastructure, in some form, has been around for a long time, but the growth of the sector over the last three years has made it harder for investors to ignore,” Graham said.