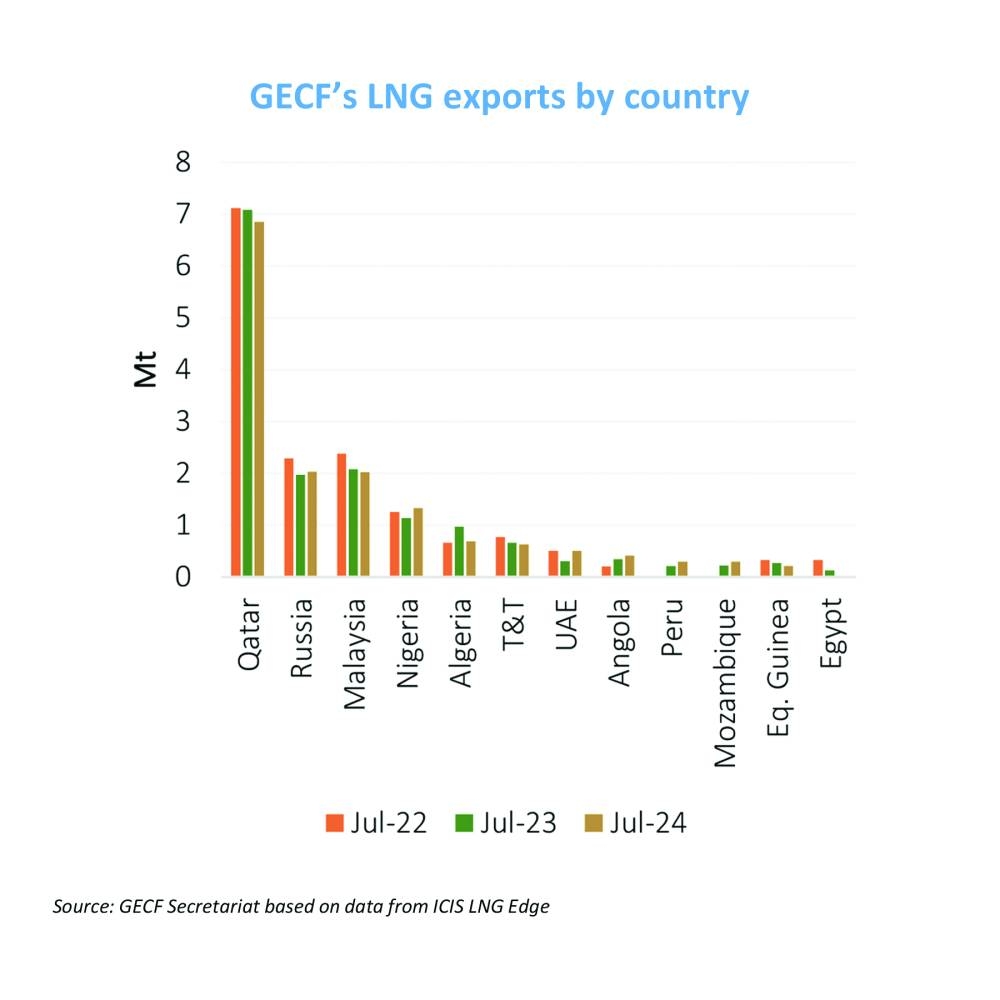

Qatar remains the top liquefied natural gas exporter in the Gas Exporting Countries Forum and figures among the top three LNG exporters globally in July, latest report by GECF has shown.

According to the Doha-headquartered GECF, the US, Qatar and Australia were the top three LNG exporters globally last month.

In July 2024, global LNG exports increased marginally by 1.1% (0.36mn tonnes) y-o-y to 33.36mn tonnes.

This growth, according to GECF’s monthly report was supported by higher exports from non-GECF countries and an uptick in LNG re-exports, which offset lower exports from GECF Member Countries. Non-GECF countries maintained their dominance in global LNG exports with a market share of 53.0%, up from 52.8% in July 2023. The market share of LNG re-exports also increased from 0.6% to 1.2% during the same period, while GECF’s market share declined slightly from 46.6% to 45.8%.

Between January and July this year, global LNG exports reached 239.41mn tonnes, representing an increase of 1.1% (2.63 Mt) y-o-y.

In July 2024, global LNG imports reached 32.7mn tonnes, marking a 1.8% y-o-y increase and reversing two consecutive months of declines, GECF noted.

The growth was driven by the Asia Pacific and MENA regions, which offset declines in Europe and Latin America. A significant spot LNG price spread between Asia Pacific and Europe attracted more LNG cargoes to the Asia Pacific region.

Additionally, hotter-than-usual weather supported higher LNG imports in Asia Pacific. Conversely, Europe's LNG imports declined due to lower gas consumption, high storage levels, and stable pipeline gas supply, with the EU LNG imports reaching 13.3bcm, which was the same level as one year ago.

On the supply side, US LNG exports fell to their second-lowest monthly level in 2024 due to the impact of Hurricane Beryl on operations at the Freeport LNG facility.

According to GECF, gas restocking continue in the EU in July, with the average volume of gas in storage increasing to 84.4bcm, which is equal to an average regional capacity of 81%. Similarly, in the US, the average gas storage level continued to trend above the five-year range, while increasing to 91.2bcm, or 68% of the country’s capacity.

In Asia, the combined volume of LNG in storage in Japan and South Korea was at 14.2bcm.

Gas and LNG spot prices in Europe and Asia declined after a four-month rally, GECF said.

The average Title Transfer Facility (TTF) spot price was $10.24/MMBtu, reflecting a 5% m-o-m decrease.

Similarly, the average North East Asia (NEA) spot LNG price experienced a 3% m-o-m decrease to $11.99/MMBtu (Million British thermal units).

Additionally, in the US, Henry Hub prices plummeted, averaging $2.07/MMBtu.

“Looking ahead, expectations of above-normal temperatures may increase gas demand for cooling, potentially supporting prices. However, high gas storage levels and robust LNG supply may temper any price gains,” GECF noted.

Qatar remains the top liquefied natural gas exporter in the Gas Exporting Countries Forum and figures among the top three LNG exporters globally in July, latest report by GECF has shown.