UK Government's expected pro-business and pragmatic programme may represent relevant measures to increase long-term economic growth in the United Kingdom, according to QNB.

After 14 years of Conservative rule in the UK, the landslide victory by centre-left Labour Party represents a major shift in the country’s political scenario.

“Prime Minister Keir Starmer is now at the centre stage, and is expected to advance a pro-business and pragmatic programme that will prioritise economic growth. Improving the UK’s economic performance is a daunting challenge, given the country’s track record of decelerating growth in recent decades,” QNB noted in an economic commentary.

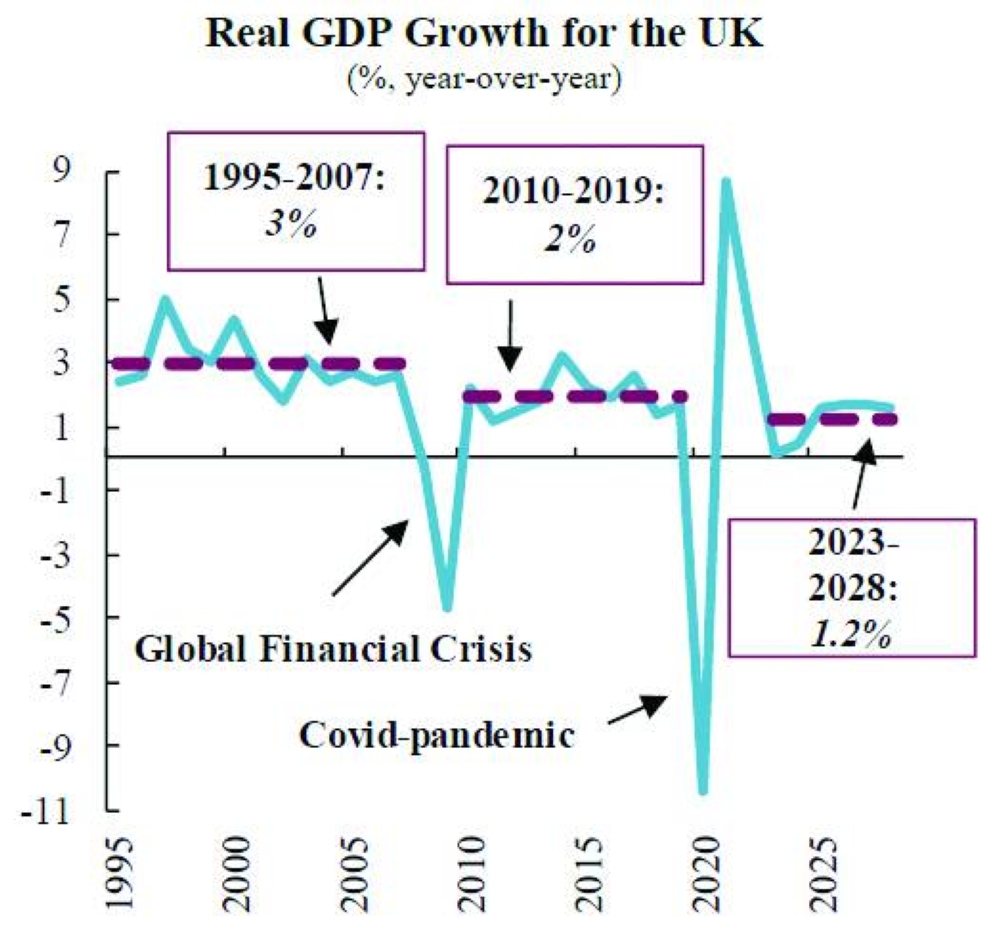

In recent decades, the UK’s average real GDP growth rates have weakened from 3% during 1995-2007 (before the Global Financial Crisis), to 2% during 2010-2019 (before the Covid-pandemic), and are expected to average 1.2% during 2023-2028. Given this trend, economic growth has now become the “national mission” for the newly elected government.

Critically, there is limited fiscal space for the new administration to shift the economy into a higher gear. Government debt as a percentage of GDP stands near 100%, the highest level in over 60 years, QNB said.

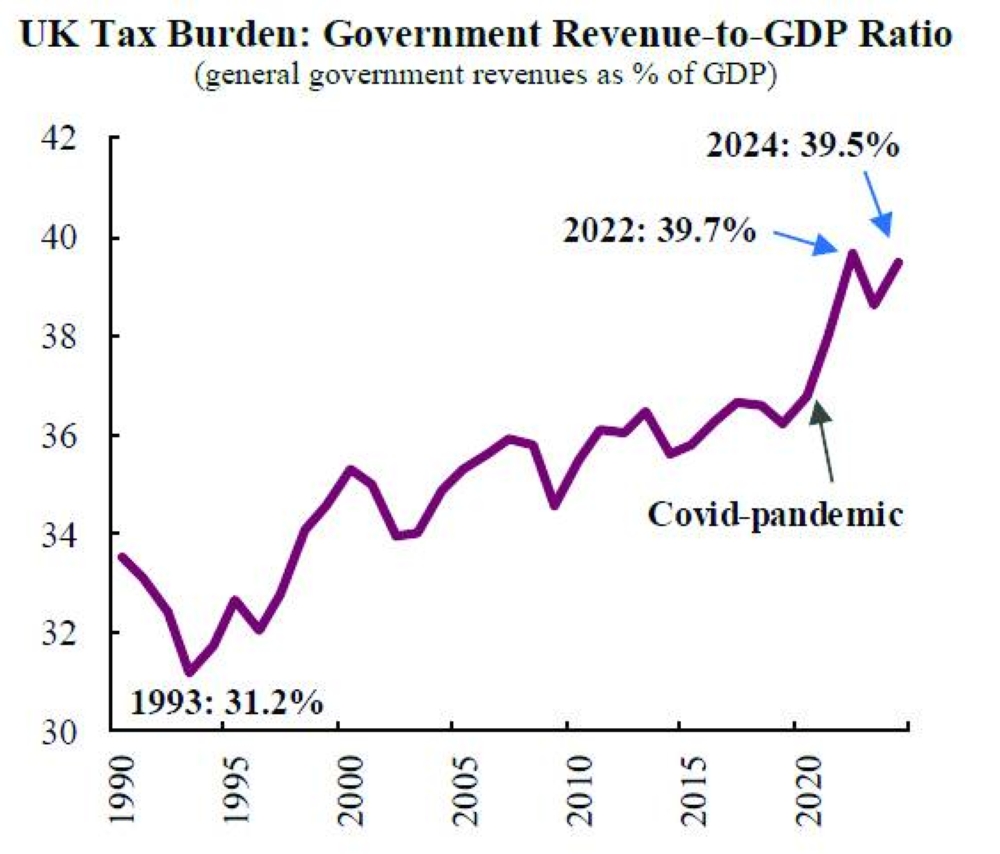

Furthermore, the tax burden (measured as the ratio of government revenues to GDP) is close to its highest in over 70 years. Additionally, the new administration had pledged not to increase corporate, income, national insurance, and VAT taxes, which together account for 75% of revenues.

Thus, fiscal conditions are currently tight relative to the UK’s historical values, with limited room for aggressive fiscal policy.

In this article, QNB discusses three priorities for the new government in its mission to achieve a stronger long-term growth performance.

First, several proposals are in the pipeline to boost the country’s housing infrastructure, support new investments, reduce red tape, and lower project costs. The UK construction planning system is widely considered costly and overly stringent.

Unpredictable and lengthy planning permissions increase development costs significantly, hindering residential and commercial construction, as well as infrastructure projects. The system has been extremely costly for the economy: the country has seen no increase in the amount of built-up land per capita since 1990, which is in stark contrast to other G7 economies.

It has also contributed to a depressed rate of business investment relative to peers with less stringent planning regimes. Chancellor of the Exchequer Rachel Reeves vowed to overhaul the National Planning Policy Framework and to “get Britain building again,” proposing a target of 1.5mn homes in the next 5 years. This overhaul would represent one of the major pillars in the strategy to improve UK’s growth performance.

Second, a newly created National Wealth Fund will be established to mobilise capital and increase investments in priority sectors. Since 2000, both public and private investment as a share of the economy in the UK have remained persistently below the average for the G7.

Therefore, it is not surprising that the new administration is taking measures to increase investment. Although the mandate and organizational structure of the new fund are still to be defined, it is expected to cooperate closely with private financial institutions to channel resources to key economic sectors such as ports, steel, carbon capture and green hydrogen, and factories.

The government has made a commitment of £7.3bn ($9.7bn) to this project, and expects to “crowd in” investment from the private sector, by attracting three pounds for every one pound invested by the government.

By leveraging private sector resources, the National Wealth Fund would be able to circumvent fiscal limitations, and increase investment to levels consistent with higher economic growth rates.

Third, the government plans to boost trade as a central part of the strategy to deliver stronger growth. New legislation is set to facilitate the alignment of product standards with the EU.

This regulatory alignment will reduce the uncertainty and the additional costs for firms of adapting to EU rules. Furthermore, after a pause in negotiations imposed by the elections, the UK has restarted talks with India, the GCC, South Korea, Switzerland, Israel and Türkiye to reach new trade agreements.

Given the importance of global value chains, obstacles to trade impact commerce with all partners. Higher trade barriers affect the costs of foreign supplies, reducing the competitiveness of UK-based production, and the ability of firms to reap the benefits of international trade, QNB noted.

The improved alignment of product standards with the EU and the new trade agreements will improve external competitiveness and open new markets for business, providing an additional impulse to growth.

“The details of the government’s plans are still to be refined and implemented, and therefore it is still too early to assess the overall impact on the economy.

“However, in our view, an overhaul of the planning system, the creation of a national fund to increase investment, and improved trade relations with the EU and other commercial partners represent relevant measures to increase long-term economic growth in the UK,” QNB added.

Business

New government's pro-business and pragmatic programme may spur UK's long-term growth: QNB

New government's measures may spur UK's long-term growth: QNB