The International Monetary Fund will this week begin its delayed fourth review of Egypt's 46-month loan programme, Prime Minister Mostafa Madbouly said on Sunday.

The review had originally been scheduled for the end of September.

It comes under an agreement Cairo signed with the IMF in April, expanding an original loan from $3bn to $8bn to help Egypt manage its economic challenges.

The fourth review will unlock $1.2bn in new financing.

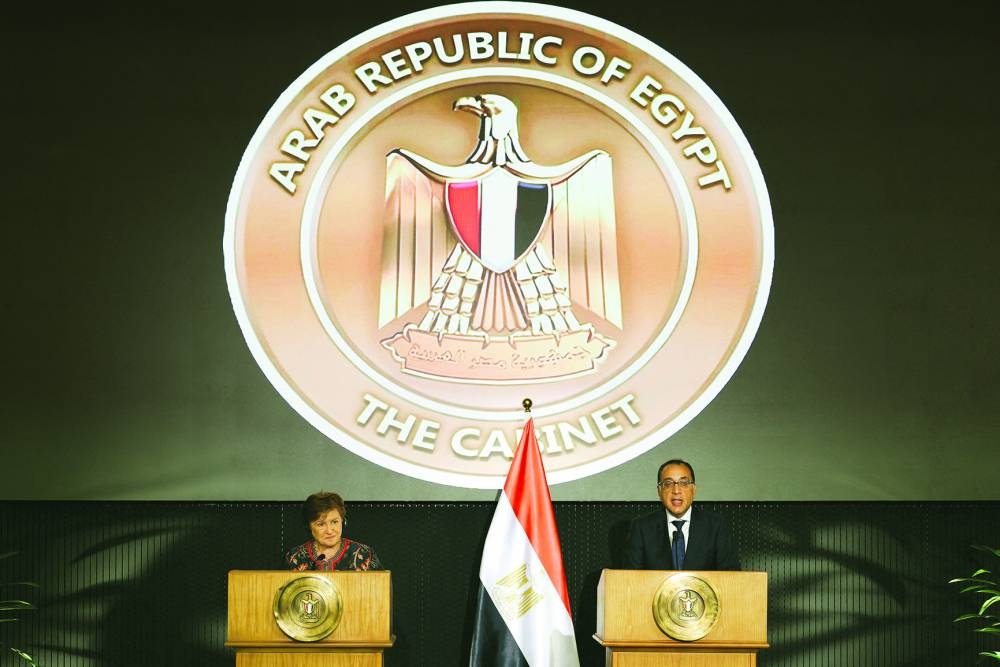

At a Cairo joint news conference with IMF's managing director Kristalina Georgieva, Madbouly said the IMF team would start work on the review on Tuesday "with Egypt's central bank and relevant ministries".

Georgieva praised "the commitment and the strength of the actions Egypt has already taken".

She cited moving to "a flexible exchange rate regime", boosting "the role of the private sector as a source of growth and jobs" and consolidating "social protection by moving away from untargeted subsidies".

The IMF chief acknowledged the challenges faced by the country's economy amid regional conflicts.

She said "conditions have become more difficult for no fault of your own, but because of the conflict in your neighbourhood".

Earlier on Sunday, Georgieva met President Abdel Fattah al-Sisi.

A statement from the presidency quoted al-Sisi as saying Egypt "would prioritise easing the burden of inflation on citizens", focusing on curbing rising prices, attracting investments and empowering the private sector.

The government raised fuel prices last month by up to 17% after inflation hit 26.4% in September.

Last month, al-Sisi said his government might reconsider the loan programme if it creates "unsustainable public pressure".

He cited challenges from ongoing regional instability, particularly the prolonged conflict in the Gaza Strip.

Despite the rising cost of living, Georgieva said on Sunday Egyptians "will see the benefits of these reforms in a more dynamic, more prosperous Egyptian economy".

She said she expected inflation to slide to 16%-17% by the end of this fiscal year (to June 2025) after peaking at 37%.

Jihad Azour, the IMF's Middle East and Central Asia director, last week also acknowledged challenges faced by Egypt's economy.

In addition to the Gaza, Lebanon and Sudan conflicts, he cited a significant decline in Suez Canal revenue.

"The reduction in trade volume going through the Suez Canal has affected revenues by more than 60% to 70% on average, which would represent $4.5b to $5bn in revenues," Azour said.

In May, the IMF said traffic through the canal dropped by 66% the previous month as ships avoided Red Sea shipping lanes to avoid attacks by the Houthi rebels in Yemen.

International Monetary Fund's (IMF) Managing Director Kristalina Georgieva attends a press conference with Egyptian Prime Minister Mostafa Madbouly in the Cabinet at the New Administrative Capital (NAC) east of Cairo on Sunday.