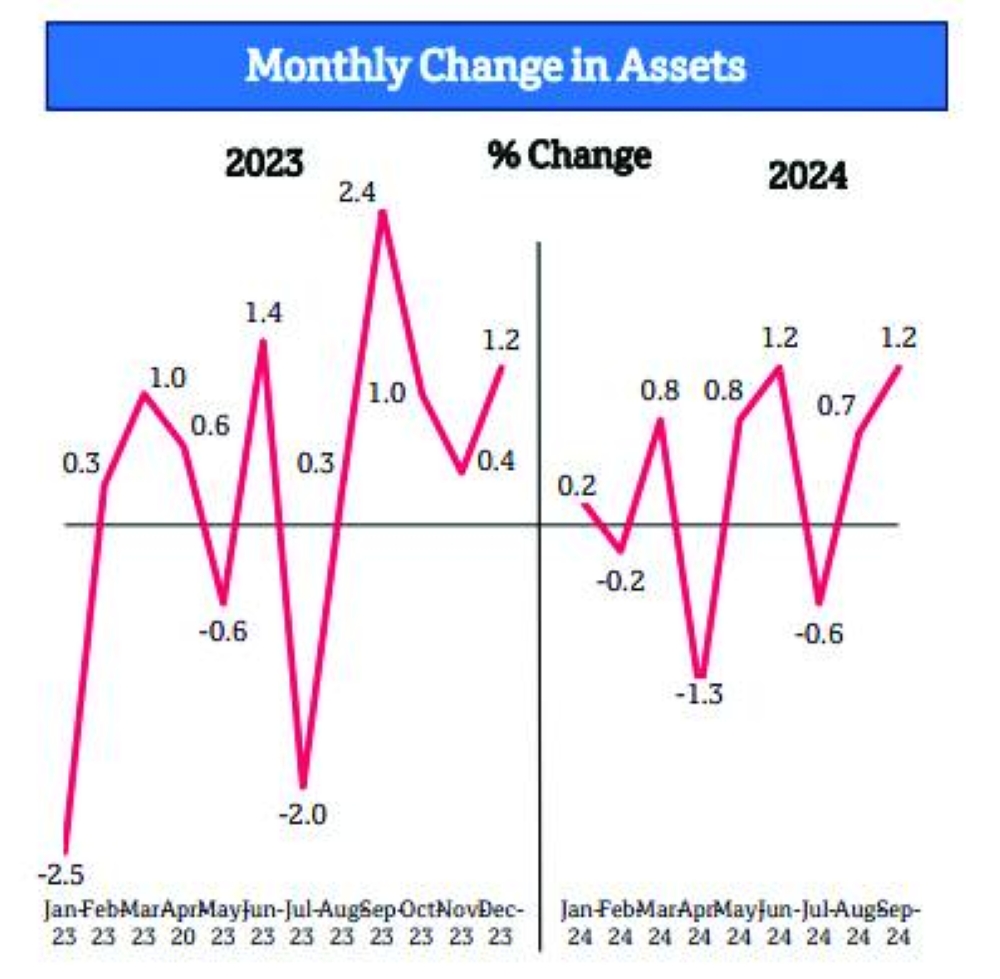

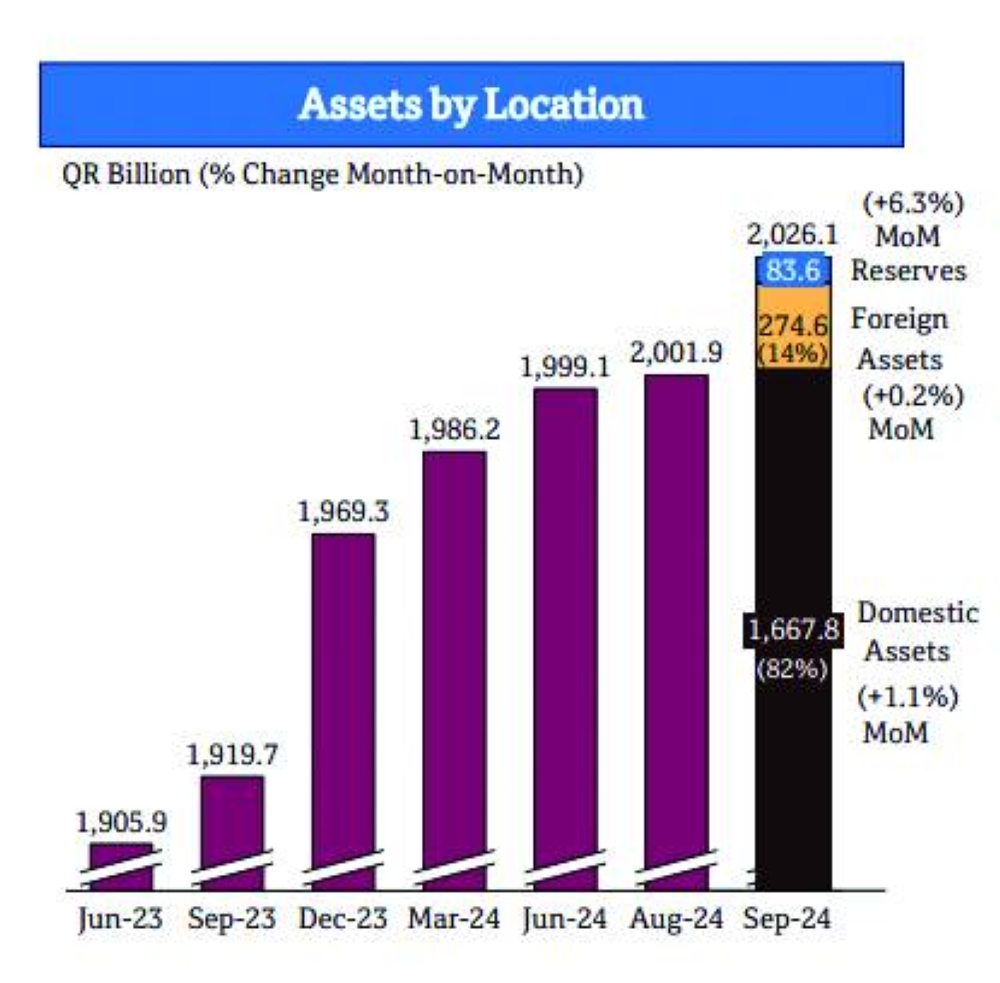

Qatar's banking sector saw total assets reach QR2.03tn in September 2024, an increase of 1.2% month-on-month and 2.9% year-on-year, according to QNB Financial Services (QNBFS).

The asset enhancement in September has been on account of a 1.1% rise in domestic assets, QNBFS said in its ‘Qatar Monthly Key Banking Indicators’.

Liquid assets to total assets went up to 30.3% in September 2024 compared to 29.8% in August 2024, which remains in a "healthy" position, it said.

The banks’ total assets had grown by an average 6.8% over the past five years (2019-23).

The loan book moved up by 0.5% month-on-month (up 4.8% in 2024), while deposits went up by 1.1% (up 6.2% in 2024) in September 2024. Loans grew by an average 6.5% during 2019-2023.

With deposits rising (1%) more than loans during September, the LDR (loan-to-deposit ratio) slipped to 128.9% against 129.7% in August 2024.

Loan provisions to gross loans edged up to 4.2% in September 2024 compared to August 2024, the report said.

The overall loan book moved up by 0.5% in September 2024, pushed up mainly by private sector loans, which expanded 0.7% month-on-month (+3.5% in 2024) during September 2024.

Consumption and others was the main driver for the private sector loans in September 2024. Consumption and others (contributes about 20% to private sector loans) increased by 2.7% month-on-month, while services (about 32%) moved up by 0.2% month-on-month (+3.9% in 2024), with general trade (about 21%) going up by 0.3% (+3.6% in 2024) and the real estate (about 21%) gaining 0.2% (+8.8% in 2024) in the review period.

Total public sector loans were marginally down month-on-month (+6.3% in 2024) in September 2024, which remains the primary drive of credit. The semi-government institutions segment was the main catalyst for the public sector decline with a 2.3% drop (-8.3% in 2024), while the government institutions’ segment (representing about 65% of public sector loans) went down by 0.2% (+6.7% in 2024). However, the government segment (about 29%) went up by 0.8% (+8.6% in 2024) during September 2024.

The banks' overseas loans edged up by 0.3% month-on-month (+13.9% in 2024) in September.

Public sector deposits grew 1.3% month-on-month (+10.3% in 2024) in September 2024. The government institutions’ deposits (representing about 55% of public sector deposits) rose by 1.5% (+8.2% in 2024), while the semi-government institutions’ segment moved up 0.6% (-12.7% in 2024) in September.

Non-resident deposits increased by 2% month-on-month (+11.3% in 2024) during September 2024. Non-resident Deposits as a percentage of total deposits moved up to 19% as at September 2024 compared to 18.2% at year-end 2023; indicating that banks are still relying on external funding.

Private sector deposits in banks was higher by 0.6% month-on-month (+1.1% in 2024) in September. On the private sector front, the consumer segment increased by 1% (+7.2% in 2024), which indicates retail prefer to increase their savings vis-a-vis borrowings. Moreover, companies and institutions’ edged up by 0.2% (-5.7% in 2024).

The return on equity or RoE for the banking sector stood at an annualised 11.1% at the end of September 2024 against 14.9% at year-end 2023. Major drag on the overall sector RoEs is mainly due to low single digit RoEs generated by Masraf Al Rayan and Doha Bank. On the other hand, QNB Group and Qatar Islamic Bank continue to generate strong double digit RoEs, QNBFS said.

Business

Qatar banks’ total assets reach QR2.03tn in September, liquid assets remain 'healthy': QNBFS