The clear takeaway is that nearly every business – from a hardware store in North Carolina to a corner shop in Nairobi – can strengthen its resilience to climate change by joining in the digital economy.

The global effort to counteract climate change has expanded rapidly in recent years. The energy and automotive industries are overhauling supply chains to boost uptake of clean technologies. Governments are implementing policies to accelerate the green transition, from the European Union’s Carbon Border Adjustment Mechanism to the United States’ Inflation Reduction Act.

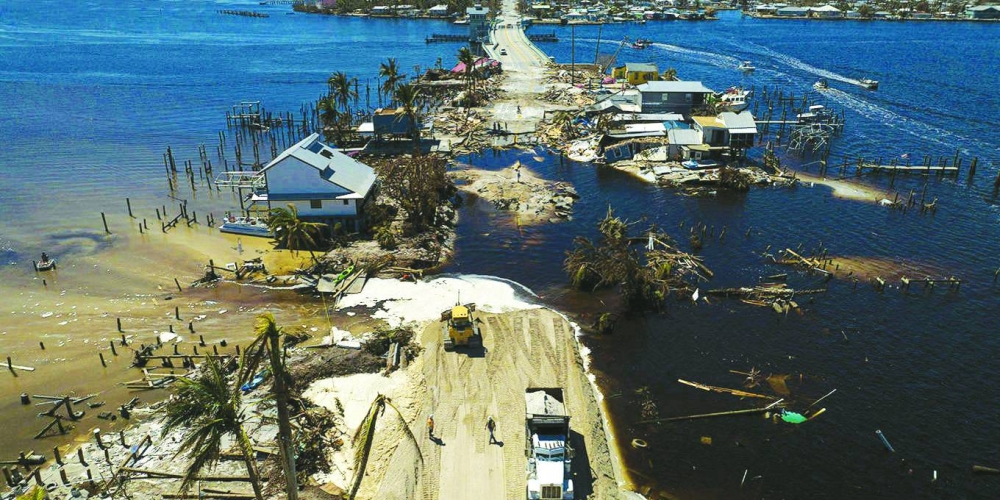

But measures to promote digital and financial inclusion – the critical work of providing internet access to left-behind communities, bank accounts to workers, and digital tools to entrepreneurs – are often missing in the fight against global warming. The report on the impact of hurricanes, conducted by the World Bank, the Sustainable and Green Finance Institute, and the Mastercard Economics Institute, illustrates why integrating these measures into climate action plans would have a powerful effect.

More than 1bn unbanked people live in the most climate-vulnerable countries, and improving their access to digital banking and payment services would make them and their communities more resilient to both economic and climate shocks. Following a natural disaster, households could more easily receive relief funds through digital money transfers, and businesses could continue selling to their customers online.

This represents a clear opportunity, especially for fintechs and nonprofits, to create more products and services at the intersection of climate resilience and digital inclusion. One good example is the social enterprise Abalobi, an Earthshot Prize finalist in 2023. Abalobi created an app that small-scale fishers can use to input catches, showing exactly where they are fishing.

The app addresses two problems. First, it provides invaluable data to governments and scientists about who is fishing sustainably and who is not. Second, small-scale fishers often sell through middlemen who pay low prices, which forces them to reel in as much as they can to make a living. But by using the app’s digital marketplace, these fishers can connect directly with restaurants and other buyers, enabling them to sell their catch for higher prices. This allows them to fish more selectively, in turn reducing the strain on marine life.

Yo! Pay Agric, powered by Mastercard Community Pass, likewise enables smallholder farmers to connect with regional buyers through their farmer cooperative organisations, bypassing middlemen and earning them higher prices for their crops. Transaction data from these sales can be used by farmers to establish their creditworthiness, making it easier for them to secure loans to invest in seeds, fertiliser, and clean-energy solutions such as solar-powered farm equipment.

Digital and financial inclusion must become a core pillar of future climate efforts, with a focus on reducing the number of unbanked individuals and building digital infrastructure in climate-vulnerable communities. To that end, private companies, governments, and nonprofits need to work together to create innovative solutions, including products like Abalobi and Yo! Pay. This approach would help local users improve their financial health while simultaneously promoting resilience.

Climate change and poverty are intertwined: we cannot effectively tackle one without addressing the other. Digital tools and access to financial services cannot stop climate-related disasters, but they can make it easier for people to recover from these shocks. Strengthening the financial resilience of the most climate-vulnerable households benefits local communities, while also benefiting the entire global economy. – Project Syndicate

- Ellen Jackowski is Chief Sustainability Officer at Mastercard.