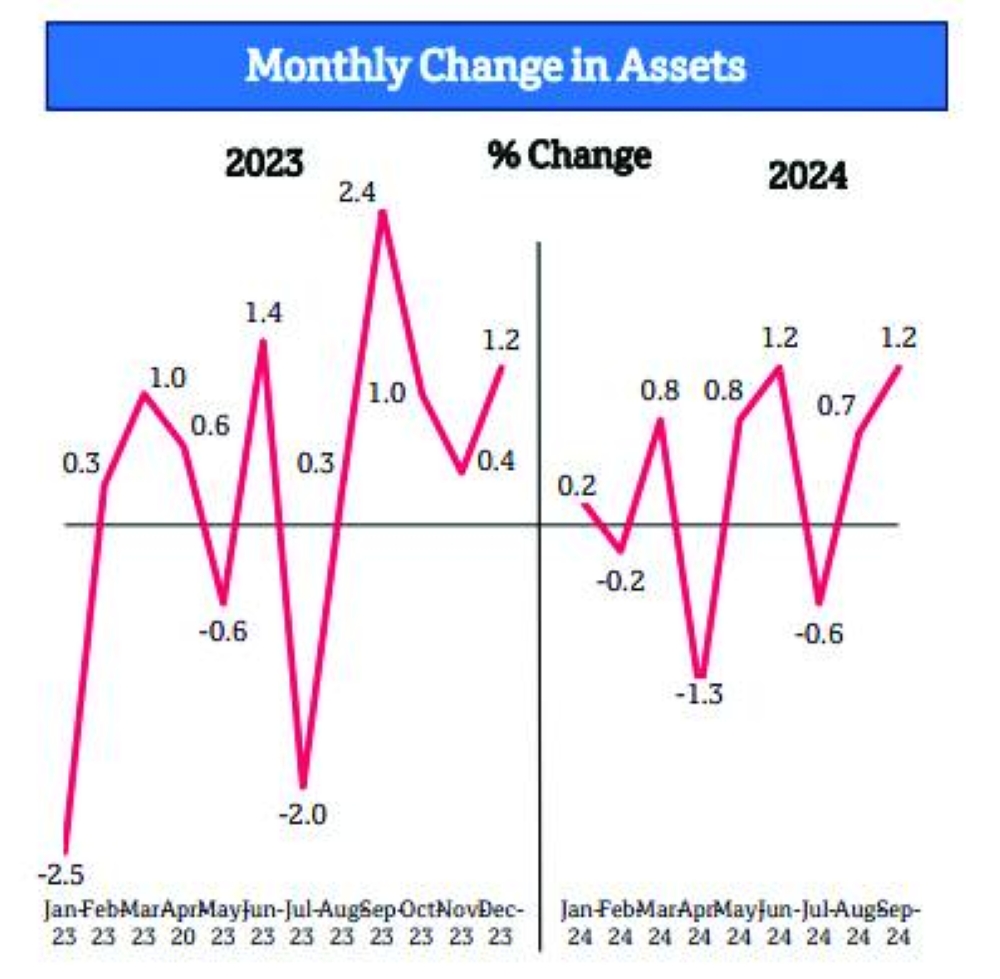

Qatar's average debt-servicing costs are expected to be below 5% of general government revenues by 2027, aided by debt reduction strategies and higher expected earnings related to the North Field Expansion or NFE, according to Standard and Poor's (S&P).Highlighting that in the recent years, Qatar's authorities have aimed to reduce the level of external debt; S&P said "we expect this to remain the case, with only partial refinancing of foreign debt coming due."In 2023, the government repaid about QR27bn (about 3.4% of GDP or gross domestic product) of its debt. This year, it expects further debt reduction of about 2% of GDP, partially offset by new debt issuance equivalent of $2.5bn (1.2% of GDP) in May 2024, S&P said in its recent report.Adding the borrowings of the country’s sovereign wealth fund, QIA or Qatar Investment Authority, equivalent to 6% of GDP to the direct government debt, the rating agency said it estimates general government debt to be 48% of GDP at year-end 2024 (versus 50% of GDP in 2023).S&P also expect this will fall to about 33% by 2027 in line with the government's debt-repayment strategy and significant increase in the nominal GDP."Continued debt reduction and an expected increase in revenue from higher gas production related to the NFE will keep average debt-servicing costs below 5% of general government revenue," it said.The country's strong general government net asset position (which it forecasts will average 125% of GDP over 2024-27) remains a credit strength, supported by investment returns on QIA's investments.Sizeable assets accumulated within the QIA will also continue to support Qatar's strong aggregate external net asset position in 2024-27, it said, adding despite this, Qatar stands out in the Gulf Cooperation Council (GCC) as having a "significant" amount of net external banking sector liabilities, which keep external financing needs high and pose a potential funding risk for the system.Regulatory directives introduced by the Qatar Central Bank in 2022 initially prompted a substantial ($23bn) reduction in potentially riskier non-resident deposit funding from year-end 2021 to August 2024. However, a jump in interbank liabilities ($8bn in the same period) partially offset the decline in non-resident deposits."Despite the increase in recent months, we expect the banking sector's external debt to broadly stabilize because we expect domestic funding sources should be able to fund the credit growth, which we believe will slow to average 5% over 2024-27 versus 11% on average during 2019-22," S&P said.

Santhosh V. Perumal

Santhosh V. Perumal, a postgraduate in Econometrics with an advance qualification in Capital Markets and Financial Services, is Gulf Times' journalist. His coverage areas are debt and equity, hydrocarbons, international trade, environment, banks, insurance and real estate. Previously, he was in New Delhi, India as Senior Finance Correspondent of PTI.

Most Read Stories

1