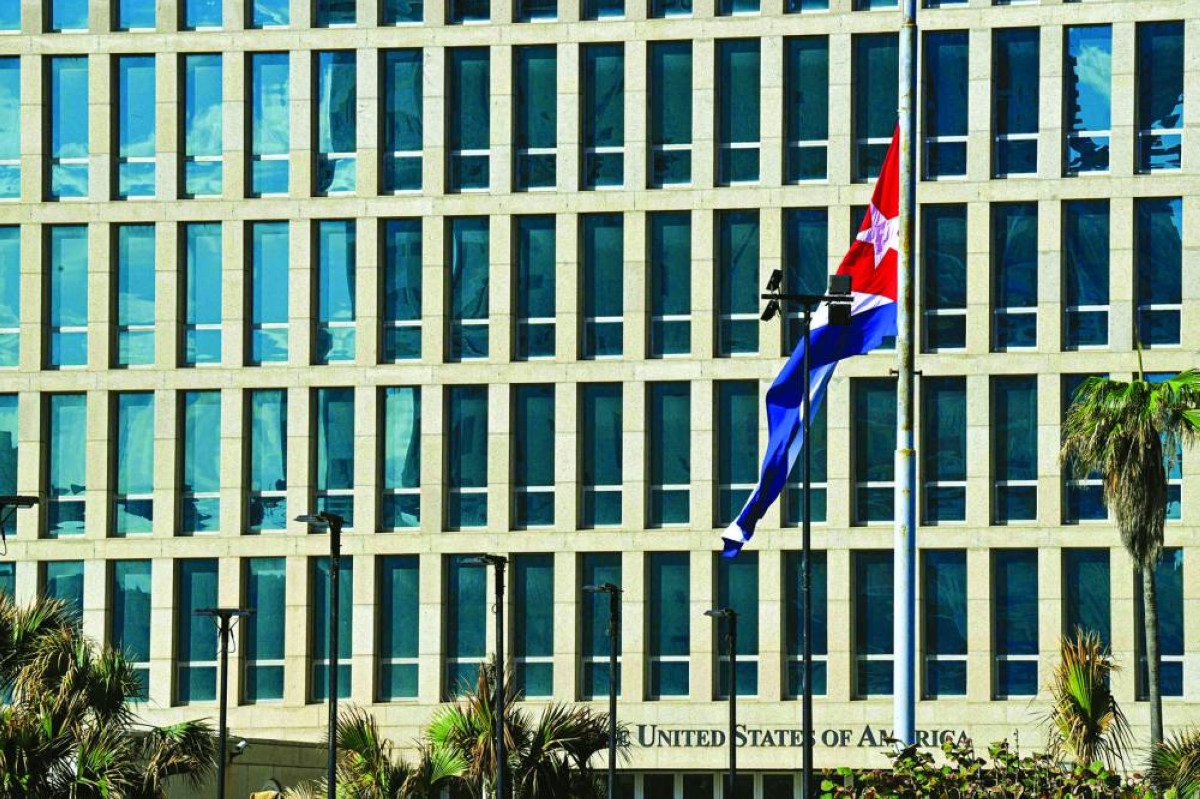

Twice in the last century, the foundations of global finance shifted, because the burden placed on the machinery of money became unsustainable. Today, we are witnessing another shift, driven by the rise of stablecoins, tokenized deposits, and central bank digital currencies (CBDCs). But, this time, change is not unfolding through treaties or exchange-rate policies. The question is no longer which central bank issues the global monetary system’s “anchor” asset, but on whose infrastructure value circulates.When Allied countries agreed in 1944 to establish a post-World War II global monetary architecture based on US economic might and a gold-backed dollar, governments accepted limits on their monetary sovereignty in exchange for stable exchange rates and a reliable supply of global liquidity, provided by the United States.As capital markets deepened, however, the Bretton Woods system became untenable. In 1971, the US abandoned dollar convertibility to gold, and the world shifted to a dollar-based floating exchange-rate regime, which was flexible enough for an increasingly integrated global economy and complex financial system, but also fragile and prone to recurrent crises. Nonetheless, the US dollar retained its dominance in international transactions and reserves, thanks to the depth and safety of US Treasury markets, the global reach of US finance, and the credibility of US institutions.Today, the structure of the global economy has changed: China is now the world’s largest trader; the eurozone is a major capital exporter; and emerging economies, such as India and the Asean countries, are central to supply chains and key sources of energy demand. But while the economy has shifted toward multipolarity, the monetary system remains largely unipolar. The dollar still accounts for roughly half of cross-border loans, some 60% of global foreign-exchange reserves, and over 50% of trade invoicing. It is also the currency against which nearly all stablecoins now in circulation are pegged.The resulting structural mismatch has far-reaching consequences, as countries worldwide – even those that have established themselves as global production hubs – remain exposed to US monetary cycles, periodic dollar shortages, and asymmetric shocks.These vulnerabilities are systemic, not episodic, reflected in the global funding gaps that occurred in 2008 with the onset of the global financial crisis, in 2020 during the Covid-19 pandemic, and in 2022 when the US Federal Reserve began raising interest rates to combat inflation. Imbalances were managed, but never resolved.The rise of digital money may now break this stalemate. The critical innovation here is not the currencies themselves, but rather the underlying settlement layers. Tokenized assets, programmable payments, and upgraded messaging frameworks enable states and private actors to build alternative infrastructure capable of circumventing legacy intermediaries. Properly designed, these monetary rails can underpin a stable open system, expanding access, reducing friction, and modernizing the world’s aging financial infrastructure.But there is another, less desirable possibility: this new monetary architecture can entrench a bipolar system, comprising competing geopolitical blocs with incompatible standards. This explains why digital-currency projects have become instruments of geopolitics. China’s cross-border CBDC pilots are as much about shaping governance norms as they are about improving efficiency. Europe’s pursuit of “digital sovereignty” is rooted in security concerns, stemming from America’s apparent unreliability as a partner. Emerging economies are building new clearing arrangements outside traditional dollar channels. Meanwhile, privately issued stablecoins are forcing governments to rethink how influence is exerted.Technology is thus achieving what politics has not: a bottom-up realignment of monetary power. The US still has the potential to lead, because its institutions remain the most trusted, its capital markets the deepest, and its reserve-asset ecosystem the strongest. But fulfilling this potential will depend as much on architecture as on assets. The threat to the dollar’s primacy is not a rival currency, but the possibility that the global financial infrastructure will evolve in ways that dilute the advantages of openness, including the network effects that make holding and settling in dollars attractive.To retain its position at the centre of the global monetary system, the US must help build the rails that will convey global liquidity in the digital era. This means upgrading domestic and cross-border payment infrastructure for interoperability, thereby avoiding digital Balkanization. It also means providing regulatory clarity on dollar-denominated stablecoins and tokenized bank liabilities, so that private actors are not conducting quasi-central-bank functions without safeguards. And it means advancing a multilateral governance framework that ensures that cross-border digital rails reflect the principles that made the post-1970s system resilient: openness, transparency, and trustworthy governance.Such a system is in everyone’s interest. For Europe and China, modernized digital-payment rails would enable greater monetary autonomy without the disadvantages of fragmentation. For emerging economies, they would provide a credible path to reducing exposure to external shocks.And for the US, they would strengthen supply-chain resilience, forestall reliance on rival digital ecosystems, and enhance investment competitiveness by making dollar assets programmable and attractive as collateral.Moreover, embedding trusted digital-identity and compliance standards into the global financial plumbing would extend US influence in commercial diplomacy and economic statecraft.An open, interoperable, standards-based monetary order could finally deliver what neither the Bretton Woods system nor the floating exchange-rate regime could simultaneously: liquidity, stability, and sovereignty. -- Project SyndicateSilvia Sgherri is a visiting scholar and adjunct professor at the George Washington University’s Elliott School of International Affairs.