By Pratap John/Chief Business ReporterGCC

Among the GCC countries, the UK imports largest quantity of gas from Qatar.

Qatar has been the most active GCC investor in the UK in recent years, and has rapidly built up a large portfolio of assets ranging from Harrods to a 26% stake in Sainsbury’s, the UK’s third largest supermarket chain.

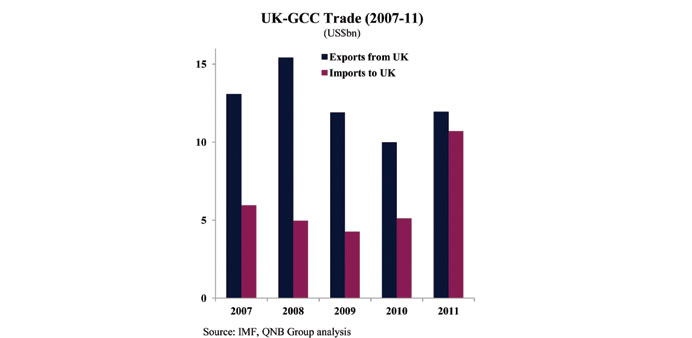

The GCC is among the UK’s top ten destinations for exports and also its main source of hydrocarbon imports, after Norway. From the GCC’s perspective, the UK is its ninth most important supplier of imported good, according to IMF data. In addition to physical trade, the UK is also a major supplier of business services to the region.

On the investment side, the UK has long been a focus for GCC investors, who own many iconic buildings in London and sizable stakes in blue chip firms. Gulf investors take a long-term view of UK investments, and see the current weakness in the economy and Sterling as an opportunity to expand their portfolios.

The UK is currently looking to foreign investors to contribute to its £310bn National Infrastructure Plan. Existing GCC infrastructure involvement includes the £1.5bn London Gateway port development, by the UAE’s DP World.

Other GCC investors have expressed interest in the planned infrastructure projects. At the same time, many UK companies are involved in delivering major infrastructure and real estate projects in the GCC, and in direct investments in the region, which generated £0.8bn of income for UK firms in 2010.

QNB Group expects that the mutually-beneficial relationship between the UK and the GCC will continue and strengthen in the years to come.

The UK economy is still struggling to recover from the effects of the global economic crisis in 2008-09. Nonetheless, its importance as a trade and investment partner of the GCC is growing, according to QNB Group.

However, QNB said the UK’s GDP declined by 6.3% from April 2008 to June 2009. Recovery has been sluggish and, four years on, the economy has still not regained the lost ground and is unlikely to do so before 2015.

Two sectors which have been a drag on the UK’s recovery are financial services and hydrocarbons. Efforts to reduce the government’s deficit have also weighed on growth in the near term.

Firstly, financial services are a major component of the economy, representing around 10% of total GDP, given the role of the City of London as a global financial hub. Prior to the crisis, financial services had been expanding at around twice the rate of the overall economy. In its aftermath, however, the financial sector has been much weaker and constrained by a need to de-leverage balance sheets.

Secondly, the UK’s oil and gas production has been in rapid decline as many of the North Sea fields mature. This decline is unrelated to the economic crisis, but its timing has made economic recover more difficult. The UK was a net exporter of oil until 2005 (and of gas until 2004).

However, oil production was just 0.9mn barrels per day in 2012, half the level in 2005 and a third of the peak production achieved in 1999. The reserves/production ratio for oil is less than a decade, although new investment and exploration should help.

On the gas front, there are some prospects for onshore shale gas, bolstered recently by tax-allowances in the 2013 budget. The decline in UK gas production has prompted imports from Qatar.

Thirdly, the UK government has implemented a painful austerity programme since 2010 to try and bring the fiscal deficit under control. The government faces a difficult balancing act with its public debt. It needs to slow the rate of nominal increase by reducing the primary deficit but it also needs GDP growth, which is harmed by austerity, to reduce the size of the debt relative to the overall economy. Although the UK lost its cherished AAA credit rating, when it was downgraded by Moody’s in February 2013, this did not result in a notable increase in its borrowing costs as its rational was already priced into the market.