By Arno Maierbrugger/Gulf Times Correspondent/Bangkok

Two Southeast Asian countries not particularly known for large agricultural exports, Myanmar and Cambodia, have both declared that they want to participate in the global rice business by intensifying rice farming and milling across their respective countries with the help of foreign investors, including from the Middle East, China, South Korea, Japan and Thailand.

Myanmar used to have a buoyant rice industry and, as a matter of fact, was the largest rice exporter in the world before the 1960s, but with the military government taking over in 1962, the industry quickly declined. Today, the most acute problems are low productivity and poor rice quality at the farm level, with paddy yields only half of those in other exporters in the region such as Thailand and Vietnam. The milling sector is in dire need of upgrading its processing units to end significant losses in quality and quantity during the milling. Infrastructure upgrades along trade routes and ports are also necessary, as well as better water management in the central plains where most of the rice fields are located.

Vichai Sriprasert, honorary president of the Thai Rice Exporters Association who was on a working visit in Myanmar in early February, said that up to 8mn hectares of land in Myanmar – in addition to the existing farmland used for rice – could be developed. A large rice mill with a capacity of 500 tonnes a year would cost an investment of just around $9.4mn, excluding land.

So far, most of the rice produced in Myanmar, around 12.6mn tonnes annually, is used for domestic consumption. Yearly export is just slightly over 1mn tonnes. However, the government has set itself the target of exporting 2mn tonnes of rice this year and 4mn tonnes by 2020, mainly to China, the European Union and the Middle East.

Cambodia, on the other hand, has even more complex problems. In a country where 80% of the population actually works on farms, productivity and yields of rice farming used to be among the world’s lowest, with only slight improvement in the past decades after the country shrugged off its war-torn past. Main issues are underuse of arable land, low-quality seeds, poor infrastructure and no government-induced financing or loan programmes for farmers, let alone for agricultural research. However, the government in Phnom Penh has adopted a new rice policy to promote growth in paddy production and milled rice exports to match the growth seen in the garment and service sectors, also with the help of foreign investors. The Cambodia Rice Federation has said it will set up a rice development fund to educate farmers and promote Cambodian rice overseas.

Of Cambodia’s total production of around 4.7mn tonnes of milled rice in 2014, the country exported just 387,100 tonnes. The initial target for 2015 was 1mn tonnes of rice exports, which will be “unlikely to achieve due to lack of milling capacity and funding,” Cambodian Minister of Commerce Sun Chanthol said early February. “We are trying to find new foreign markets for our rice,” he added.

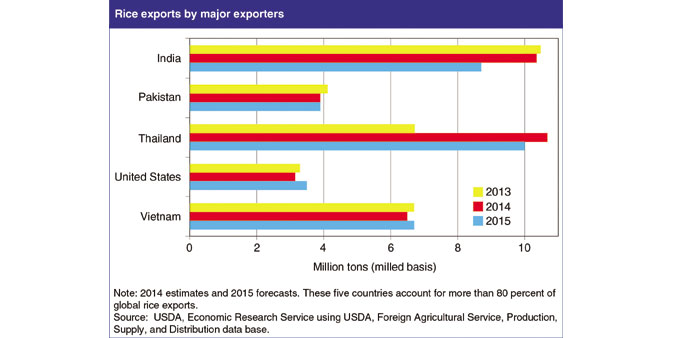

Globally, Thailand claims to have regained its crown as the world’s largest rice exporter in 2014 after the end of a structurally damaging rice-pledging scheme, selling 10.9mn tonnes abroad in the year, slightly more than India with 10.13mn tonnes. Vietnam came third with 6.3mn tonnes, ahead of Pakistan with around 4mn tonnes and the US with more than 3mn tonnes of milled rice. The global rice trade is expected to hit 41.9mn tonnes this year.