Fintech, or financial technology with its potential to disrupt traditional structures in the financial industry, is seen as an important factor to change the perception and dissemination of Islamic finance in the Muslim, as well as in the non-Muslim world.

Gulf Times in the past repeatedly reported about new ventures that combine Shariah-compliant financing principles with new technologies, such as web-based Islamic crowdfunding and peer-to-peer lending, as well as other forms of IT-based alternative financing including special variants such as Bitcoin-based, Shariah-complaint micro-lending.

The latest conferences on Islamic finance, for example the World Islamic Banking Conference 2015 held last December in Manama, Bahrain; the International Forum on Islamic Finance 2016 held last week in Karthoum, Sudan; the Euromoney Islamic Finance and Investment Conference, also held last week in London, as well as the upcoming Islamic Banking & Investment Asia/Middle East Congress 2016 to be held in Singapore in early April all are focusing on new financial technologies featuring “out-of-the-box, forward-looking visionaries” from beyond the traditional confines of the Islamic finance industry.

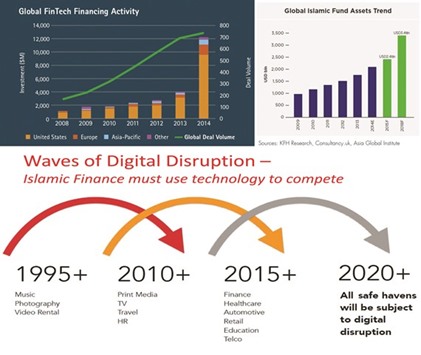

Globally and financial industry-wide, fintech ventures tripled from around $4bn in capital investment in 2013 to $12.2bn in 2014 and more than $15bn in 2015. While most of the start-ups and inventions so far have been focusing on the conventional finance industry, its influence on the Islamic finance sector cannot be overseen.

Among the most prominent disruptive ventures in Islamic finance is Dubai-based Beehive, a platform that aims to provide low-cost alternative financing to small and medium enterprises (SMEs) and is the first peer-to-peer lending platform in the world to have received independent Shariah certification.

“Our platform applies the innovative technology of crowdfunding to eliminate cost and complexity of traditional finance,” says Beehive’s CEO Craig Moore, adding that “businesses can bypass traditional intermediaries and receive financing directly from the crowd.

Beehive uses commodity murabaha contracts to purchase and resell traded commodity on the Dubai Multi Commodities Center at specified prices as underlying assets for Shariah-compliant loans and has so far provided more than $4bn in financing for SMEs in the UAE, where the SME sector is an important pillar of the economy, but traditionally underserved by banks, including Islamic banks. This market potential and the underlying technology made Beehive a remarkable success.

Another Islamic fintech company, Blossom Finance in Indonesia, provides a Shariah-compliant platform which is Bitcoin-based and provides easy-access alternative financing to SMEs in a country where the vast majority of people in still unbanked. Much like Beehive, the company aims to build “mutually beneficial partnerships” of growth between investors and SEMs by applying the innovative technology of crowd funding to eliminate costs and complexity of banks.

Other examples for innovative Shariah-compliant finance ventures are Kapital Boost, a Singapore-based Islamic crowdfunding platform, and Club Ethis, a Islamic finance-based real estate crowdfunding venture, also from Singapore.

With such innovative ventures, it becomes clear that disruption in finance will happen first in the areas with the highest fees and largest complexities, and this is where traditional Islamic banks have their weaknesses. This also means that Islamic banks will very likely have to face dropping margins in key areas like credit intermediation unless they open themselves to fintech innovation.

“Automation, customer empowerment, easily accessible advisory services, streamlined infrastructure and data analysis, namely from social data, will all be common important themes affecting Islamic finance operations in the future,” says Akash Anand, head of Middle East, Africa & Asia Pacific operations at UK-based fintech company Profile Software.

..