In its latest World Economic Outlook (WEO), the International Monetary Fund (IMF) forecast acceleration in global growth for 2018 to 3.9% from 3.8% in 2017.

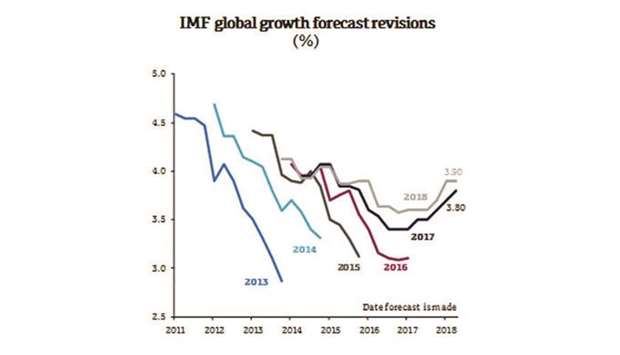

The IMF has historically held a bias for optimistic growth forecasts and repeatedly revised down its forecasts with each release of the WEO until very recently, QNB said.

“We regard the IMF forecasts as too optimistic and expect a slowdown in the global economy to 3.6% in 2018,” QNB said.

QNB Economics has therefore developed its own forecasts and laid out four main reasons it expects the global economy to slow in 2018.

First, recent economic data suggests that the global economy has already begun to slow. The latest global Purchasing Managers Index (PMI) survey, released at the beginning of April, was the weakest in 16 months.

While the reading of 53.3 is still in expansion territory (above 50), it is below the average reading in 2017 of 53.8.

Additionally, recent indicators of growth in the world’s largest economy, the US also suggest a slowdown.

The Atlanta Fed produces an estimate of GDP in the US, based on the latest data, which points to growth of 2% in the first quarter of 2018, down from 2.9% in Q4, 2017 and 2.3% for 2017 as whole.

Second, the Chinese economy is expected to slow in 2018 due to continued policy tightening. The authorities aim to cool the property market, reign in leverage in the shadow banking sector, and further cut capacity in old industries.

The first quarter (Q1) GDP was steady compared to the previous quarter at 6.8%, but marginally down from full-year 2017 growth of 6.9%. Additionally, slower credit growth points to further cooling of the economy during the remainder of 2018. Credit growth slowed to 10.5% year on year in March 2018, down from a recent peak of 13.2% in July 2017. China is the largest contributor to global growth and a slowdown in China is also likely to have knock-on effects in a number of other economies, particularly in Asia.

Third, global monetary policy is likely to become less accommodative in 2018. The Fed is expected to press ahead with planned rate hikes and the European Central Bank has halved monthly asset purchases since January 1 and is expected to wind down the programme further from September.

Both the Bank of Japan and Bank of England are also expected to tighten policy. As a result, global financial conditions are likely to tighten and long-term bond yields are rising, which is likely to restrain growth.

Fourth, higher oil prices could also be a drag on growth as they reduce the disposable income of consumers in oil importing countries. Low oil prices during 2014-16 were not fully passed on to the consumer as a number of countries took the opportunity to cut subsidies.

However, since oil prices have started rising, subsidies have not been reinstated, so the cost of higher prices is likely to be more fully passed on to consumers. Oil prices averaged $55/barrel in 2017 and QNB expects them to average $63 in 2018 for the full year. As a result, rising oil prices pose another headwind for global growth in 2018, it said.

According to QNB, the main positive driver of global growth this year is likely to be fiscal stimulus in the US, which introduced a number of tax reforms, including a reduction in the corporate tax rate from 35% to 21%.

The IMF stated in its latest WEO that it expects the US fiscal stimulus to add around 0.1 percentage points to global GDP growth in 2018. The various drags on growth that we have outlined above will more than offset the boost to growth from the US fiscal stimulus.

The expected slowdown in China alone is sufficient to subtract around 0.1 percentage points from global growth, before the knock-on effects on other economies are taken into consideration. QNB therefore has concluded that it expects global growth to slow from 3.8% in 2017 to around 3.6% this year.